Liquidation is a complex process that marks the end of a company's legal existence. It occurs when a company is unable to repay its debts and its assets are sold off to satisfy creditors and other claimants. The liquidation process aims to wind up the company's operations and distribute its remaining assets fairly among its stakeholders. In this article, we will delve into the definition, process, and benefits of liquidation, shedding light on its different forms and the steps involved.

What is Liquidation?

Liquidation is the process by which a company is declared bankrupt and its assets are auctioned off to repay its creditors and satisfy other claims. This process applies to both small businesses and large publicly traded companies. Liquidation can be initiated when a company fails to meet its financial obligations, such as repaying loans, and is deemed unable to generate profits.

Forms of Liquidation

There are three main forms of liquidation: compulsory liquidation, members' voluntary liquidation, and creditors' voluntary liquidation.

Compulsory Liquidation

Compulsory liquidation occurs when creditors or lenders seek to liquidate a company that has failed to pay its debts within a specified timeframe. In this case, the company is forced to sell its assets to repay its creditors. Compulsory liquidation is usually the result of insolvency, where a company is unable to meet its financial obligations.

Members' Voluntary Liquidation

Members' voluntary liquidation is a voluntary process initiated by a solvent company whose owners or members decide to wind up the business. To proceed with members' voluntary liquidation, 75% of the company's members must vote in favor of the process. The appointed liquidator will then settle the company's debts and distribute any remaining funds to the shareholders.

Creditors' Voluntary Liquidation

Creditors' voluntary liquidation is initiated by a company's directors when they realize that the company cannot meet its financial obligations or its liabilities exceed its assets value. The directors appoint a liquidator to handle the company's legal and financial matters, and they actively participate in the liquidation process to repay the company's debts.

The Liquidation Process

The liquidation process begins when certain conditions are met and approved by the Adjudicating Authority. Once the liquidation order is sanctioned, a resolution professional is appointed as the liquidator to oversee the process. The liquidation process can be summarized in the following steps:

Step 1: Appointment of Liquidator

The resolution professional, who is already involved in the resolution process, acts as the liquidator until a specific order is issued. The liquidator assumes the powers previously held by the board, directors, creditors, and corporate debtors. All creditors provide assistance and cooperation to the liquidator in managing the company's affairs.

Step 2: Public Announcement and Claims Submission

After the liquidation order is issued, a public notice is published within five days, inviting creditors and claimants to submit their claims. The liquidator collects and verifies these claims within 30 days from the commencement of the liquidation process. Additionally, registered valuers are appointed to assess the value of the company's assets.

Step 3: Verification and Approval of Claims

The liquidator verifies the submitted claims within 30 days from the beginning of the liquidation process and may request supporting documents from creditors and debtors. Once the claims are confirmed, the liquidator approves or rejects them, either in full or in part. The liquidator acknowledges receipt of claims within seven days and any disputes can be appealed within 14 days.

Step 4: Preparation of Reports and Asset Memorandum

The liquidator prepares various reports throughout the liquidation process. These include the Preliminary Report, Annual Report, Minimum Consultation Minutes, and Final Report. An asset memorandum is also prepared, containing the valuation of the company's assets based on the valuation and sales reports. These reports are submitted to the relevant authorities.

Step 5: Liquidation of Assets and Debt Repayment

The liquidator begins selling off the company's assets, excluding cash and bank balances, based on priorities and the necessity of repayment. Secured creditors are given priority, followed by preferential creditors, which include government taxes and employee salaries. Debenture-holders and unsecured creditors are paid next, and any remaining funds are distributed among the shareholders.

Step 6: Surplus or Deficit

After all payments to creditors have been made, the liquidator determines if there is a surplus or deficit. If there is a surplus, the funds are distributed among the shareholders. However, if there is a deficit, shareholders may be required to contribute the unpaid portion of their share capital.

Types of Liquidation

Liquidation processes can be categorized into three types:

Voluntary Liquidation

Voluntary liquidation is initiated by the company's owners or members and is not forced by insolvency. This type of liquidation occurs when the company is solvent and capable of paying its creditors.

Creditors' Voluntary Liquidation

Creditors' voluntary liquidation occurs when the directors or shareholders of a company anticipate defaulting on creditor payments. This process does not involve court intervention.

Compulsory Liquidation

Compulsory liquidation is a court-ordered process where a company is declared unable to repay its liabilities and is forced to cease its operations.

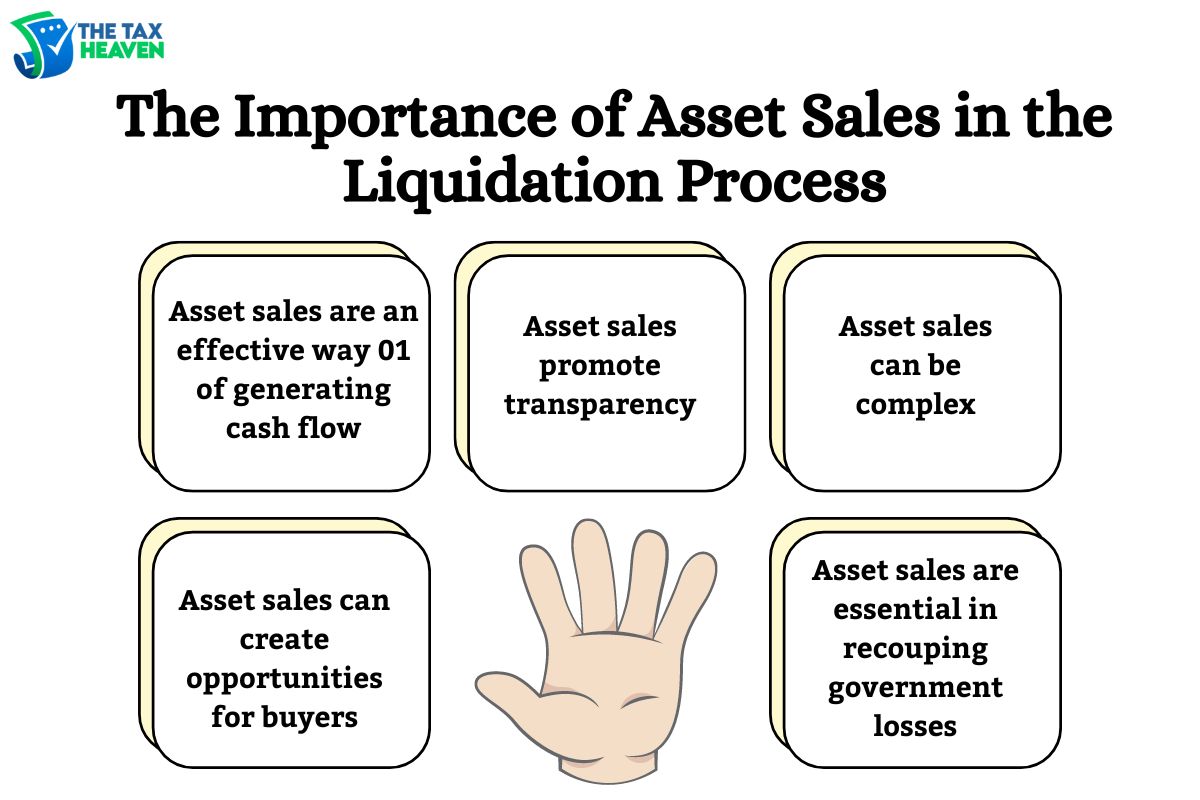

The Importance of Asset Sales in the Liquidation Process

Benefits of Liquidation

Liquidation offers several benefits, including:

Closure of a Non-profitable Company

Liquidation provides a way to close down a company that is no longer profitable. It allows the company's stakeholders to exit the business and pursue other opportunities.

Fair Distribution of Assets

Liquidation ensures the fair distribution of a company's assets among its creditors and stakeholders. The liquidation process follows a pre-established order of payment, ensuring that all parties receive their due share.

Relief for Creditors

Liquidation provides relief for creditors by allowing them to recover some or all of their outstanding debts. Creditors' claims are prioritized, and the liquidation process ensures that they are paid before other stakeholders.

Fresh Start for Stakeholders

Liquidation allows stakeholders to move on from a failed business and start anew. It offers an opportunity to learn from past mistakes and pursue more successful ventures in the future.

In conclusion, the liquidation process marks the end of a company's legal existence when it is unable to meet its financial obligations. The process involves appointing a liquidator, verifying and approving claims, selling off assets, repaying debts, and distributing remaining funds among stakeholders. Liquidation can be voluntary or compulsory, depending on the circumstances. Despite its challenges, liquidation offers benefits such as closure for non-profitable companies, fair distribution of assets, relief for creditors, and a fresh start for stakeholders.