F-14/15, Orbit Mall, Civil Lines, Jaipur-302006

support@thetaxheaven.com

support@thetaxheaven.com

In Jaipur, we make filing your tax returns easy and stress-free. Our team of experts ensures everything is done accurately, so you get the most money back with the least hassle. Whether you're a business or an individual, we're here to help with personalized service that fits your needs perfectly.

From gathering your paperwork to filing your returns, we take care of everything carefully, so you don't have to worry. With years of experience, we're committed to giving you the best income tax e-filing service in India possible.

Don't let tax season stress you out. Let The Tax Heaven handle it for you. Contact us today to find out how we can make your tax filing simple and worry-free.

File ITR Now

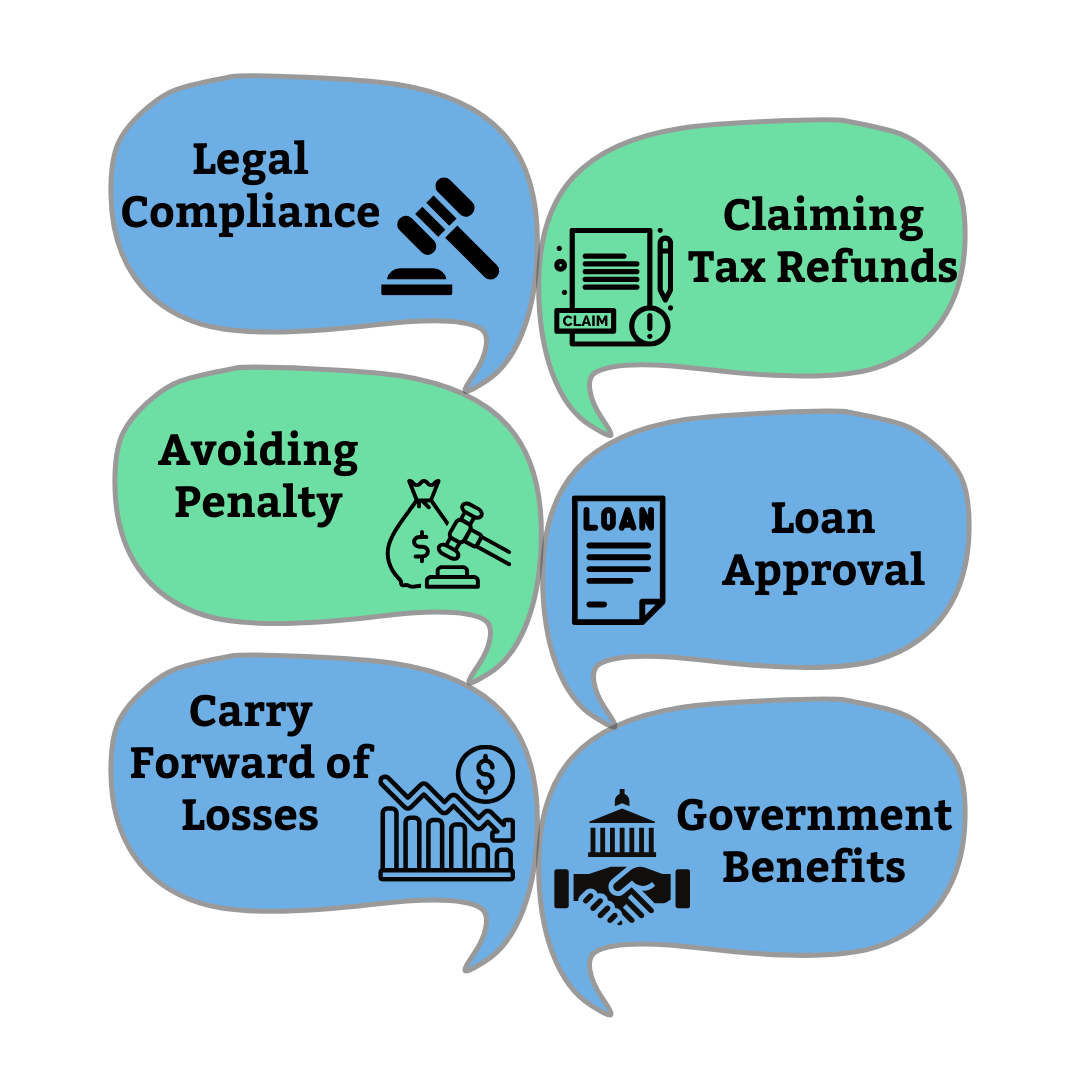

Filing Income Tax Returns offers several benefits, ensuring compliance, financial transparency, and facilitating various personal and business-related transactions.

| ITR FORM | Description |

| ITR 1 (SAHAJ) | For individuals being a resident (other than not ordinarily resident) having total income upto Rs.50 lakh, having Income from Salaries, one house property, other sources (Interest etc.), and agricultural income upto Rs.5 thousand |

| ITR 2 | For Individuals and HUFs not having income from profits and gains of business or profession |

| ITR-3 | For individuals and HUFs having income from profits and gains of business or profession |

| ITR-5 | For persons other than- (i) individual, (ii) HUF, (iii) company and (iv) person filing Form ITR-7 |

| ITR-6 | For Companies other than companies claiming exemption under section 11 |

| ITR-7 | For persons including companies required to furnish return under sections 139(4A) or 139(4B) or 139(4C) or 139(4D) only |

We make all our services simple and easy to use by keeping our customers in mind. This helps us achieve a high customer satisfaction rate. Follow these steps given below –.

Register easily with just your name, email, and phone number.

Choose you plan according to your income.

Upload your Aadhar, Pan and financial documents.

You can review the information before submission.

Complete payment to book our CA-Assisted ITR Filing Service.

Get easy tax filing with us in Jaipur. We offer expert help, personalized service, and great convenience to our taxpayers. Get more money back and worry less. Choose The Tax Heaven for all your tax needs in Jaipur!.

We believe in making professional ITR filing services accessible to all. Our pricing is designed to fit every budget, ensuring that no one is left behind in fulfilling their tax obligations.

Our team of experienced tax professionals is well-versed in the intricate nuances of Indian tax laws and regulations. We stay up-to-date with the latest changes, ensuring that your returns are always accurate and compliant.

Filing your ITR should be a straightforward and user-friendly process. Our intuitive online platform guides you through the steps, making it easy for both beginners and experienced taxpayers. We've eliminated the complexities, making it as easy as 1-2-3.

Your privacy and data security are our top priorities. We use the latest encryption technology to protect your information and never share your data with third parties. Rest assured that your financial information is in safe hands.

Avoid the hassles of last-minute filing and the risk of errors. We ensure your returns are submitted well before the deadlines, eliminating the risk of late penalties and interest charges. Trust us for ITR filing that's accurate and efficient.

| Income Slabs | Individuals (for all age categories) |

| Up to Rs 2,50,000 | Nil |

| Rs 2,50,001 - Rs 5,00,000* | 5% |

| Rs 5,00,001 - Rs 7,50,000 | 10% |

| Rs 10,00,001 - Rs 12,50,000 | 20% |

| Rs 12,50,001 - Rs 15,00,000 | 25% |

| Rs 15,00,001 and above | 30% |

| Income Slabs | Individuals of Age 60 Years to 80 Years |

| Up to Rs 3,00,000 | Nil |

| Rs 3,00,001 - Rs 5,00,000 | 5% |

| Rs 5,00,001 to Rs 10,00,000 | 20% |

| Rs 10,00,001 and above | 30% |

| Income Slabs | Income Tax Rates FY 2023-24 (AY 2024-25) |

| Up to Rs 3,00,000 | Nil |

| Rs 3,00,000 to Rs 6,00,000 | 5% on income which exceeds Rs 3,00,000 |

| Rs 6,00,000 to Rs 900,000 | Rs. 15,000 + 10% on income more than Rs 6,00,000 |

| Rs 9,00,000 to Rs 12,00,000 | Rs. 45,000 + 15% on income more than Rs 9,00,000 |

| Rs 12,00,000 to Rs 1500,000 | Rs. 90,000 + 20% on income more than Rs 12,00,000 |

| Above Rs 15,00,000 | Rs. 150,000 + 30% on income more than Rs 15,00,000 |

Most CAs provide ongoing support to their clients, so don't hesitate to reach out if you have any questions or concerns our CA Mrs. Vishwas Agarwal.

Absolutely, your information is secure with the tax heaven when using the eCA-assisted option. We prioritize data security and employ encryption protocols and secure servers to protect your information. Rest assured, confidentiality is paramount, and we handle your data with the utmost care and privacy.

Mode and process of generating and validating income tax returns through Electronic Verification Code (EVC):

It's advisable to file your income tax return even if your income is below the taxable limit, especially if you're from Jaipur. It establishes a financial record and may be required for various purposes like loans or visas.

Yes, you can revise your income tax return within a certain timeframe if you're from Jaipur and notice any errors. Our experts assist in the revision process.

Yes, the government offers tax incentives for donations made to promote traditional crafts and support artisans in Jaipur. You may qualify for deductions under Section 80G for such contributions.