Introduction

The Union Budget 2024, presented by Finance Minister Nirmala Sitharaman on 1st February 2024, has been the centre of attention for citizens, businesses, and economists alike. This year's budget aimed to address the concerns of various sectors and provide relief to salaried individuals. While some aspects of the budget were a continuation of previous policies, there were also new measures introduced to boost the economy, promote inclusive development, and lay the foundation for a sustainable future.

In this article, we will delve into the highlights of Budget 2024, covering both direct and indirect tax reforms, key priorities, infrastructure and investment plans, and the government's focus on inclusive growth. We will also explore the impact of the budget on different industries and discuss the expectations and key takeaways for taxpayers.

Budget 2024 Key Highlights LIVE: No changes in direct, or indirect tax rates

Budget 2024 Key Highlights LIVE: Finance Minister Nirmala Sitharaman announced no changes in direct and indirect tax rates. “...I do not propose any changes in tax rates in direct and indirect taxes including import duties," FM Sitharaman said in her Budget speech.

Budget 2024 live updates: Govt proposes to withdraw tax demand of up to ₹25,000 up to 2009-10, says FM Sitharaman.

This will benefit 1 crore taxpayers, she added.

Budget 2024 live news: Govt to raise ₹14.13 lakh crore for market by issuing dated securities during 2024-25, says FM Sitharaman

Download the Finance Bill:- Click here

Budget 2024 Highlights: Direct Tax Reforms

Deemed Income

Under the new tax regime, a 'Resident but Not Ordinarily Resident' person is now liable to pay taxes on money received in the form of gifts from residents if the amount exceeds ₹50,000.

Changes in New Tax Regime

The new tax regime has become the default tax system, with the government implementing five key measures to make it more attractive. Taxpayers still have the option to choose the old tax regime. The new tax regime slabs for FY 2024-25 (AY 2025-26) have been revised as follows:

|

Income Slabs |

Income Tax Rate |

|

Up to ₹3,00,000 |

Nil |

|

₹3,00,000 - ₹6,00,000 |

5% on income exceeding ₹3,00,000 |

|

₹6,00,000 - ₹9,00,000 |

₹15,000 + 10% on income exceeding ₹6,00,000 |

|

₹9,00,000 - ₹12,00,000 |

₹45,000 + 15% on income exceeding ₹9,00,000 |

|

₹12,00,000 - ₹15,00,000 |

₹90,000 + 20% on income exceeding ₹12,00,000 |

|

Above ₹15,00,000 |

₹150,000 + 30% on income exceeding ₹15,00,000 |

The new tax regime also introduces a tax rebate on an income of up to ₹7 lakhs, exempting taxpayers with such income from paying any tax. Additionally, a standard deduction of ₹50,000 has been introduced for salary income under the new tax regime, making ₹7.5 lakhs the tax-free income limit.

Furthermore, the highest surcharge under the new tax regime has been reduced to 25% from 37% for individuals earning more than ₹5 crore, resulting in a lower tax rate of 39%.

Presumptive Taxation Limits

The presumptive taxation limits for small businesses under Section 44AD and professionals like doctors, lawyers, engineers, etc., under Section 44ADA have been revised for FY 2024-25. The limits have been increased to ₹3 crores and ₹75 lakhs, respectively, with the condition that 95% of the receipts must be through online channels.

Start-ups and Co-operative Societies

Start-ups have received some favorable provisions in Budget 2024. The date of incorporation for income tax benefits has been extended to 31st March 2024, and the time limit for set-off and carry forward of losses has been increased to 10 years from incorporation.

For co-operative societies, the government has introduced new manufacturing initiatives, extended the benefit of concessional tax rates to new co-operatives commencing manufacturing by 31st March 2024, and increased the TDS limit on cash withdrawals to ₹3 crores. Additionally, the cash deposit and loan limits for Primary Agricultural Co-operative Societies (PACS) and Primary Co-operative Agriculture and Rural Development Banks (PCARDBs) have been increased to a maximum of ₹2,00,000 per member.

Agniveer Corpus Fund

To promote the Agnipath scheme, the government has made certain changes to the Agniveer Corpus Fund. Contributions made by Agniveers to the fund will be considered as a tax deduction from their income. The Central Government's contribution to the fund will also be considered as income for Agniveers, eligible for deduction. Any amount received from the Agniveer Corpus Fund by Agniveers or their nominees will be tax-free.

Other Direct Tax Updates

Several other direct tax updates have been introduced in Budget 2024:

- The exemption threshold for Leave Encashment has been increased to ₹25 lakh from ₹3 lakh for non-government employees.

- The TDS rate on taxable withdrawal of EPF has been reduced from 30% to 20%.

- Payment-based deductions to MSMEs must be made within the agreed-upon time frame, with a maximum limit of 45 days. Any payment made outside this time frame can only be deducted in the year it is paid.

- No penalty will be imposed on loans accepted or repaid by primary agricultural credit societies or primary co-operative agricultural and rural development banks to their members.

- The capital gains tax exemption limit under Section 54 to Section 54F is restricted to ₹10 crores.

- Net winnings from online gaming will be taxed at 30%, and TDS will be withheld on such net winnings from 1st July 2024.

- Donations made to the Jawaharlal Nehru Memorial Fund, Indira Gandhi Memorial Trust, and Rajiv Gandhi Foundation will not be eligible for 80G deductions.

Revised Time Limits for Completing Assessment

The time limits for completing the scrutiny assessment, best judgment assessment, and fresh assessment have been revised in Budget 2024. Scrutiny assessment and best judgment assessment must be completed within 12 months from the end of the assessment year, with an additional 12 months if the case is referred to the Transfer Pricing officer. Fresh assessment post ITAT order or revision order must be completed within 12 months from the end of the financial year in which the order is passed. Assessments pending on the date of initiation of search or requisition being made will have an additional 12 months from the regular due date.

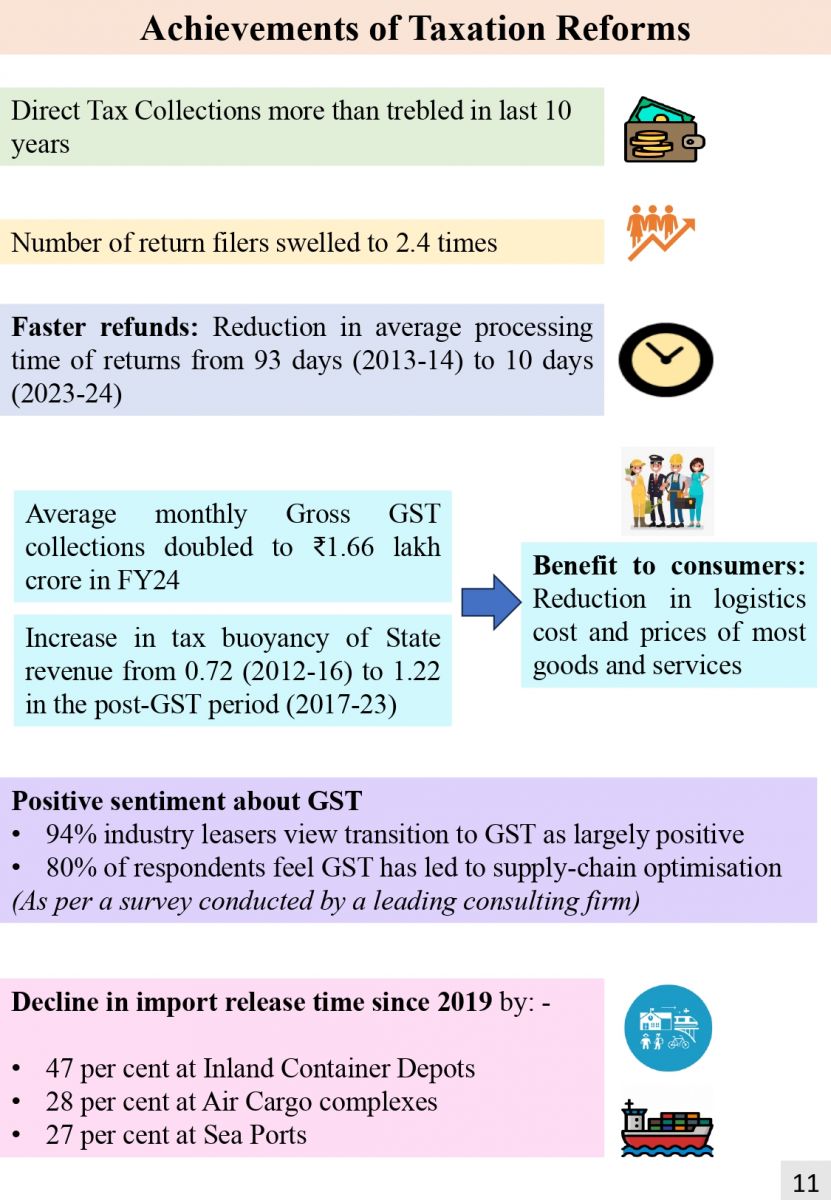

Budget 2024 Highlights: Indirect Tax Reforms

Customs Duty Changes

Budget 2024 introduced several customs duty changes aimed at promoting exports, encouraging domestic manufacturing, enhancing domestic value addition, and boosting green energy and mobility. Some of the key changes include:

- Revision of customs duties on imported capital goods for lithium-ion battery manufacturing to promote greener mobility.

- Revision of customs duties on imported mobile camera lenses to deepen value addition.

- Increase in customs duties on denatured ethyl alcohol to benefit the chemical industry.

- Reduction of basic customs duty on seeds used to manufacture Lab Grown Diamonds (LGDs) to promote exports.

- Extension of concessional Basic Customs Duty (BCD) on copper scrap to increase raw material availability for MSMEs.

- Increase in customs duties on certain goods like silver, imitation jewelry, cigarettes, and bicycles.

- Reduction of basic customs duty on electric kitchen chimneys and parts of open cells of TV panels to encourage domestic manufacturing.

- Continuation of customs duty exemption on capital goods and machinery used for manufacturing lithium-ion cells for electric vehicle batteries.

- Exemption from excise duty on GST-paid compressed bio-gas used in blended compressed natural gas.

- Minor changes in basic customs duties, cesses, and surcharges on certain imported consumables.

GST Changes

Budget 2024 also brought about some changes in the Goods and Services Tax (GST) regime. These changes include:

- Allowing taxpayers to opt for the composition scheme even if they are supplying goods through e-commerce operators where Tax Collected at Source (TCS) is collected under Section 52.

- Imposing interest on recipients who fail to pay the invoice value, including GST, to their suppliers within 180 days from the date of issue of the invoice.

- Adding expenditure on Corporate Social Responsibility (CSR) initiatives for corporates to the ineligible Input Tax Credit (ITC) list under Section 17(5).

- Treating high sea sales and similar transactions as exempt supplies, making the Input Tax Credit (ITC) proportional to such sales ineligible.

- Imposing restrictions on filing GSTR-1, GSTR-3B, GSTR-9, and GSTR-8 for a tax period after three years from the due date.

- Introducing penalties for e-commerce operators who allow unregistered persons to supply goods/services through them, facilitate inter-state supply of goods/services by ineligible registered persons, or fail to furnish accurate details in the GSTR-8 of sales made by exempted persons.

- Decriminalizing certain offenses related to obstructing officers, tampering with evidence, and failure to supply information under the CGST Act.

- Changing the compounding of offenses limits to 25% of the tax involved, up to a maximum of 100% of the tax involved.

- Introducing a new section, 158A, to allow businesses to share GST data digitally with consent for various purposes.

Budget 2024 Highlights: Key Priorities

The Union Budget 2024 outlined seven key priorities:

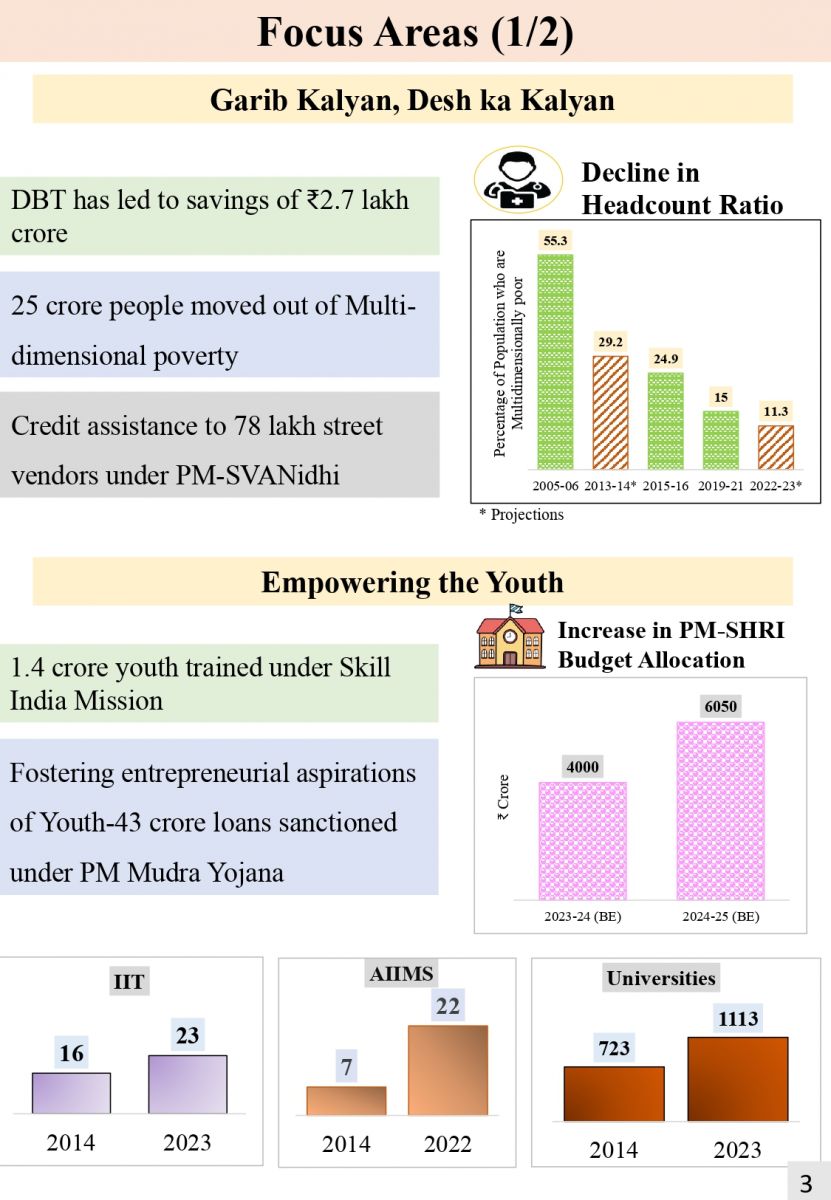

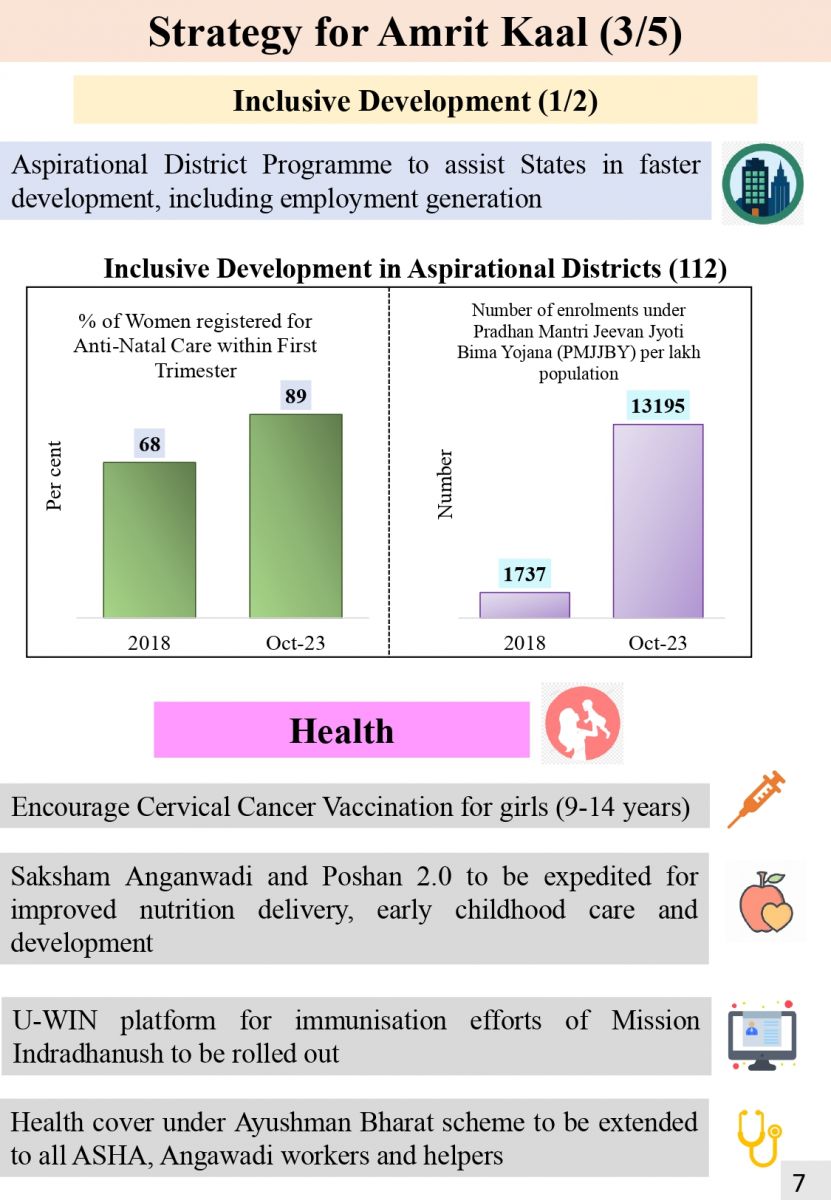

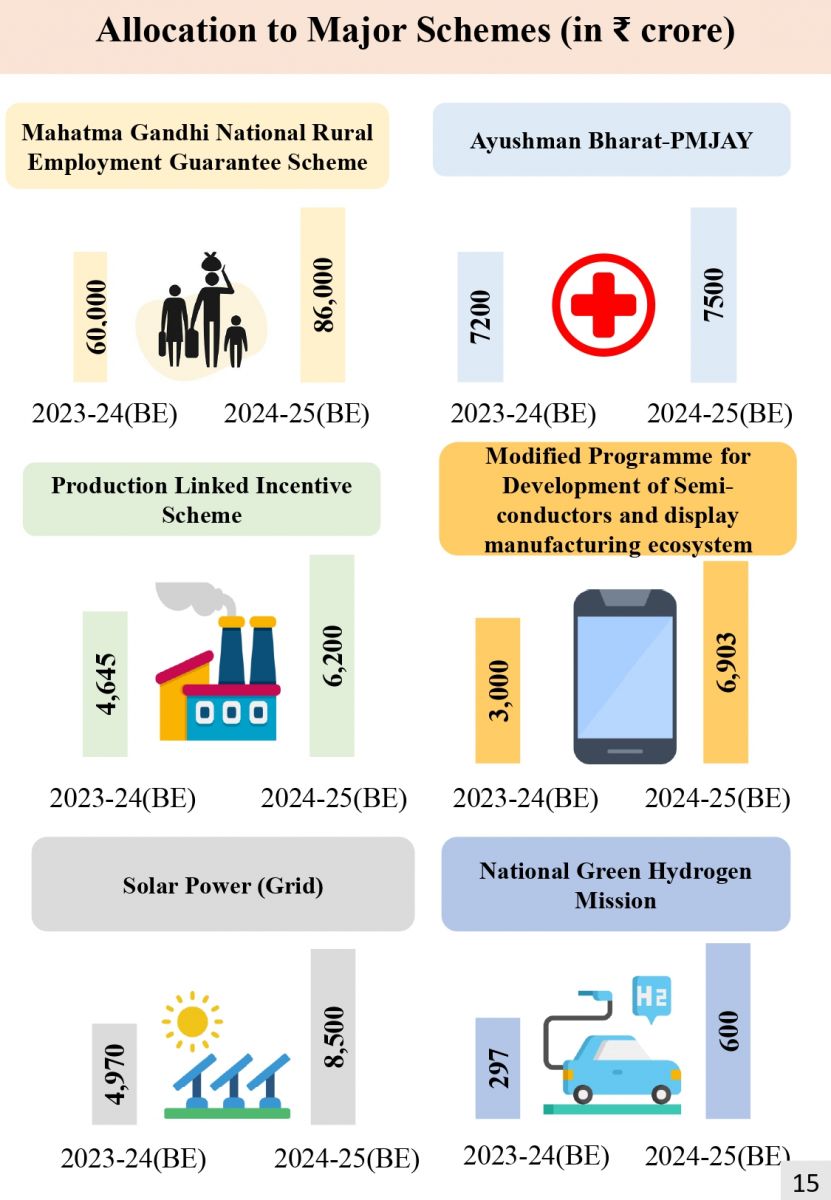

- Inclusive Development: The government aims to promote inclusive development through various initiatives, focusing on women, Scheduled Castes (SCs), Scheduled Tribes (STs), Other Backward Classes (OBCs), and other underprivileged groups. The budget allocates funds for programs like the Pradhan Mantri PVTG (Primitive Vulnerable Tribal Group) to improve the socio-economic conditions of vulnerable tribal groups.

- Reaching the Last Mile: Building on the success of the Aspirational District program, the government has proposed an outlay of Rs 15,000 crores for the newly launched Pradhan Mantri PVTG over the next three years. The budget also enhances the outlay for the Pradhan Mantri Awaas Yojana by 66% to over Rs 79,000 crores. Additionally, the government plans to hire teachers and support staff for Eklavya Model Residential Schools to cater to tribal students.

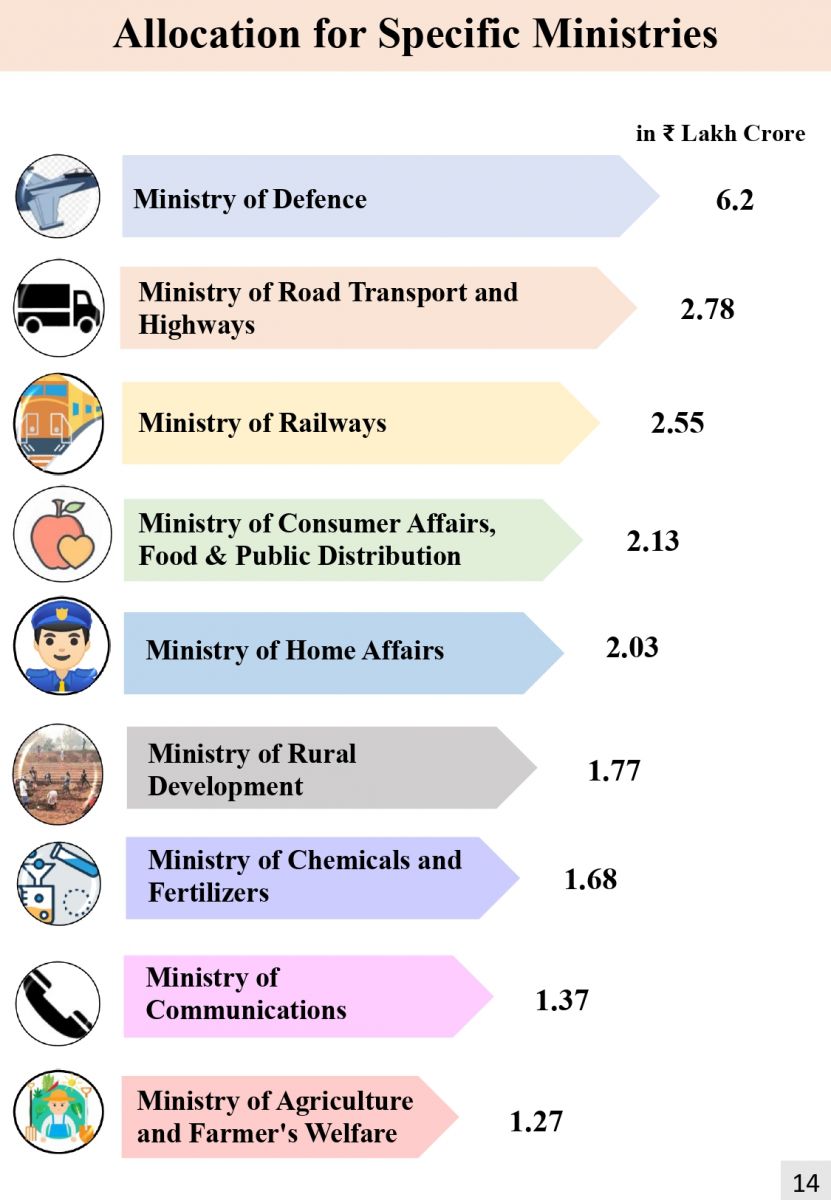

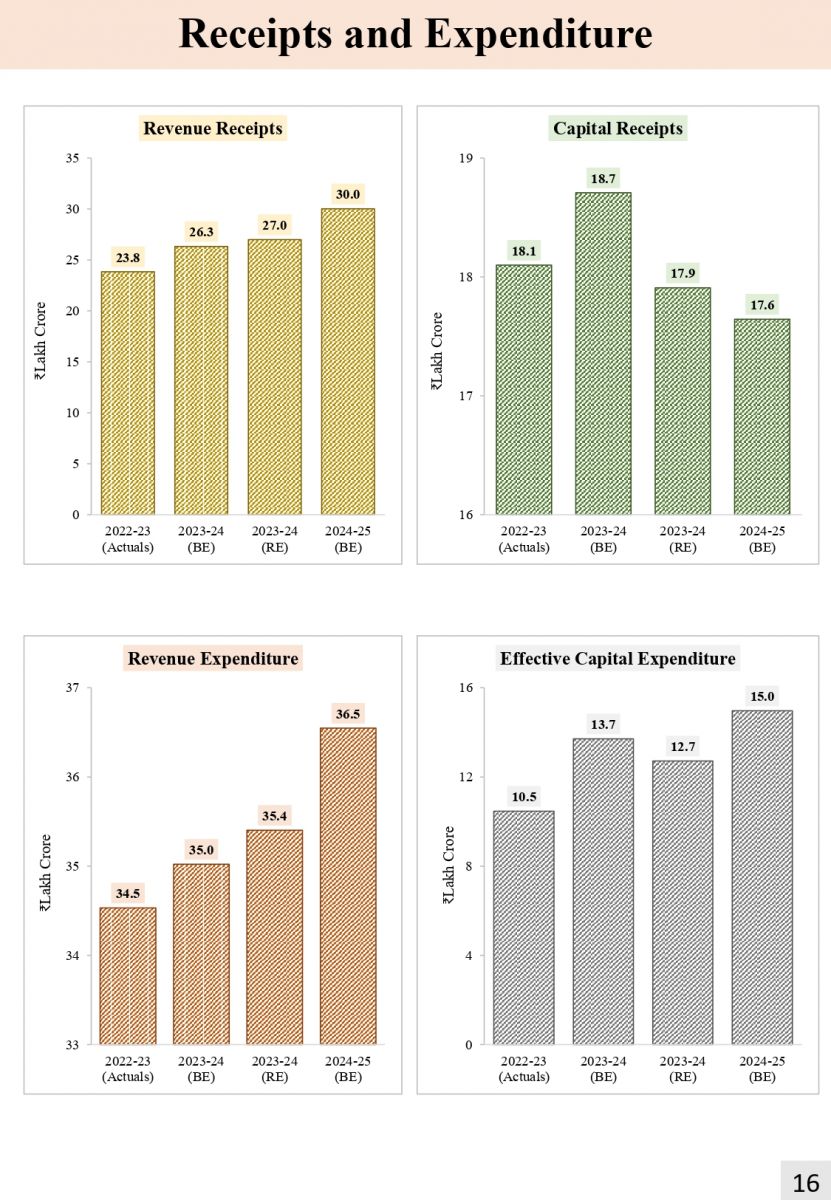

- Infrastructure and Investment: The budget emphasizes infrastructure and investment, with a proposed capital expenditure increase of 33% to Rs 10 lakh crore. The government plans to extend the 50-year interest-free loan to state governments for one more year, resulting in an outflow of Rs 1.3 lakh crore. Significant investments are also planned for railways, airports, and urban infrastructure development in tier 2 and tier 3 cities.

- Unleashing the Potential: The government aims to unleash the potential of various sectors through measures like the Vivad se Vishwas I scheme, streamlining the KYC process, introducing a National Data Governance Policy, simplifying business operations, and setting up centers of excellence for Artificial Intelligence (AI).

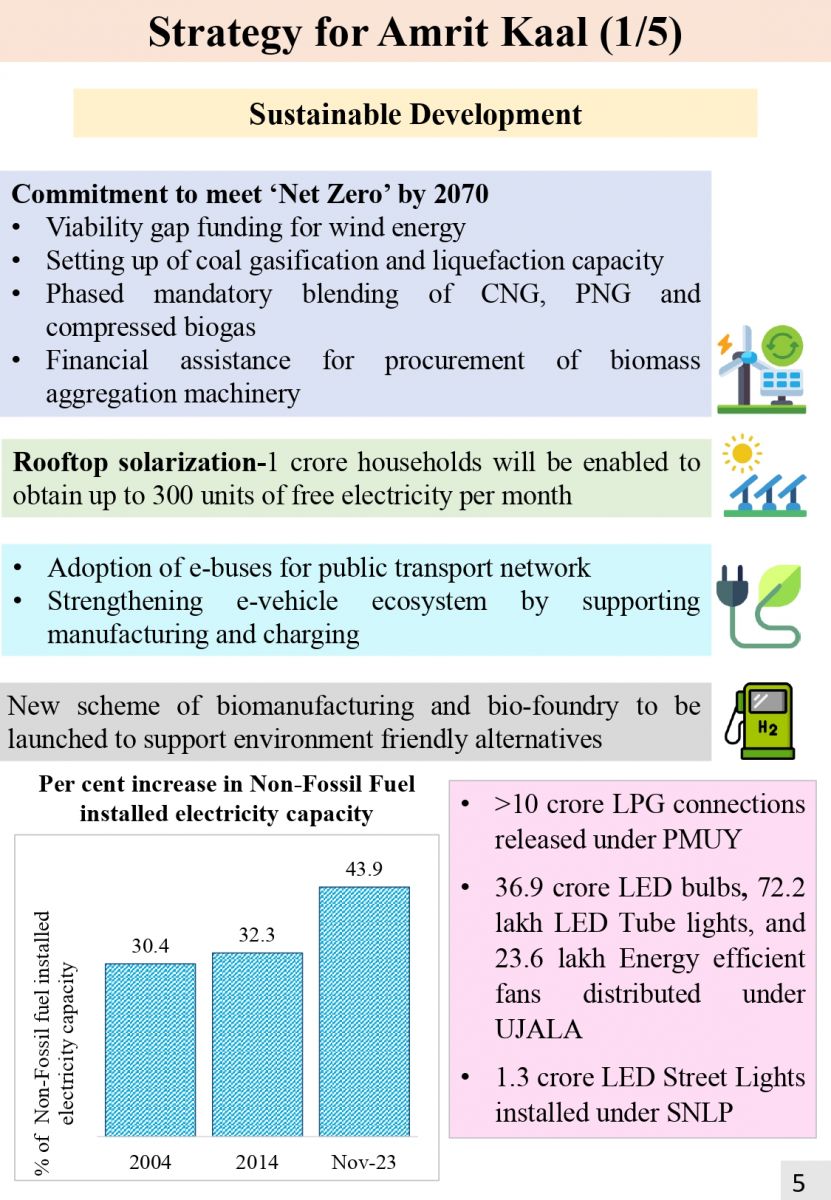

- Green Growth: The budget highlights the importance of green growth and aims to achieve net-zero carbon emissions in India by 2070. Key measures include allocating funds for the National Green Hydrogen Mission, constructing a transmission system for renewable energy, introducing a green credit program, promoting the replacement of old vehicles, and investing in battery energy storage systems.

- Youth Power: To harness the potential of the youth, the budget proposes the launch of the PM Kaushal Vikas Yojana 4.0, the National Apprenticeship Promotion Scheme, and the establishment of three centers of excellence for AI in top educational institutions.

- Financial Sector: The budget focuses on revamping credit guarantee schemes for MSMEs, implementing a unified IT system for registration and approval in the GIFT IFSC, establishing a Central Processing Center for quicker responses to businesses, and introducing an integrated IT portal to reclaim unclaimed shares and unpaid dividends.

Budget 2024: Industry Impact and Expectations

The Union Budget 2024 has significant implications for various industries. Here are some key highlights and expectations from different sectors:

Salaried Individuals

Salaried individuals have long awaited relief in the form of tax reforms. While the budget did not bring major changes to income tax slabs, it introduced a tax rebate on incomes up to ₹7 lakhs and increased the standard deduction to ₹50,000. Salaried individuals also hope for an increase in the tax exemption limit and a review of deductions like Section 80C and 80D.

Start-ups and MSMEs

Budget 2024 provided support to start-ups by extending the date of incorporation for income tax benefits and increasing the time limit for set-off and carry forward of losses. MSMEs received a boost through the revamping of credit guarantee schemes and additional collateral-free guaranteed credit of ₹2 lakh crore. These measures aim to promote entrepreneurship and ease the financial burden on small businesses.

Co-operative Societies

Co-operative societies saw various proposals in Budget 2024. The government introduced new manufacturing initiatives, extended concessional tax rates to new co-operatives, and increased the TDS limit on cash withdrawals. These measures aim to promote the growth of co-operative societies and enhance their contribution to the economy.

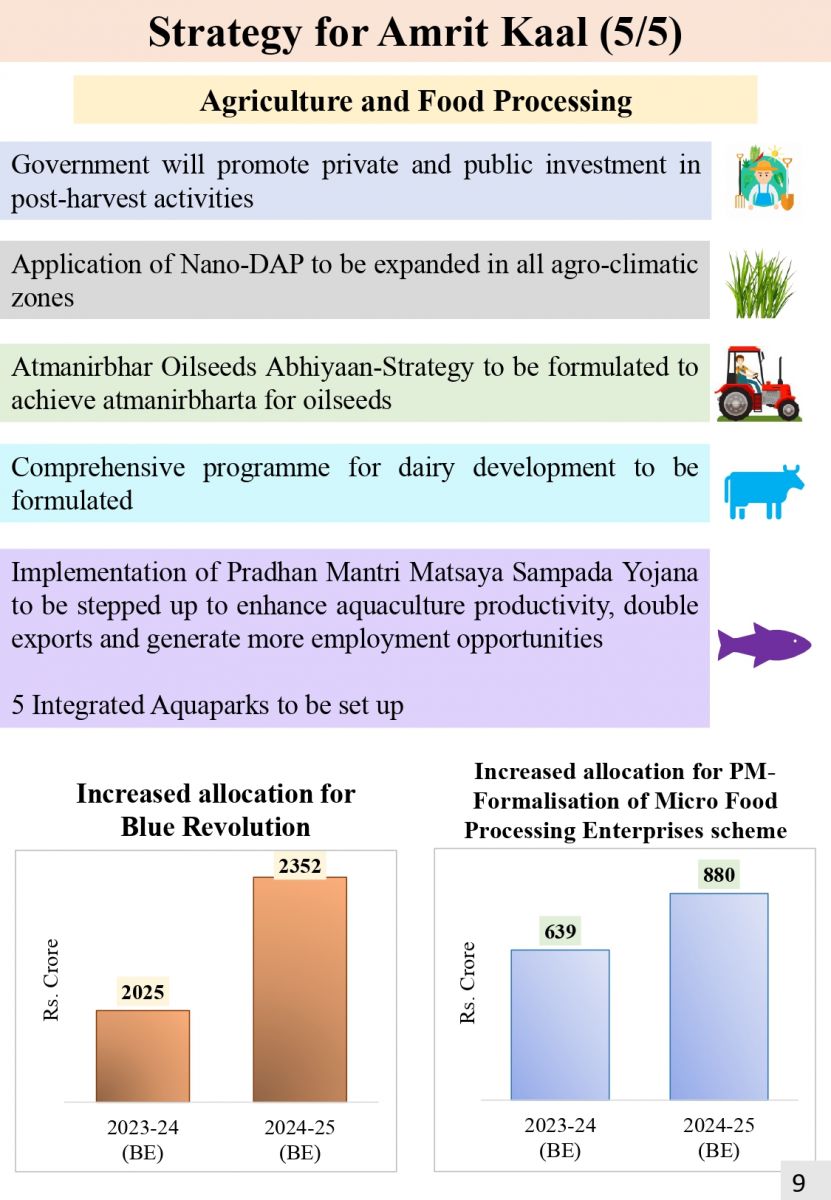

Agriculture and Rural Development

The agricultural sector received significant attention in the budget, with an increased agricultural credit target of ₹20 lakh crore and an enhanced outlay for the Pradhan Mantri Awaas Yojana. The budget also focused on the development of rural areas, with investments in infrastructure, education, and healthcare facilities.

Infrastructure and Real Estate

Infrastructure and real estate sectors witnessed a boost through increased capital expenditure, investments in railways, and the establishment of urban infrastructure development funds. The budget also proposed the revival of airports, heliports, water aerodromes, and advanced landing grounds to enhance regional air connectivity.

Healthcare

The healthcare sector received attention in Budget 2024 with increased investments in healthcare infrastructure, healthcare research, and the Pradhan Mantri Awaas Yojana. The budget aimed to improve access to quality healthcare services and enhance healthcare facilities across the country.

Renewable Energy

Budget 2024 focused on promoting green growth and renewable energy. The allocation of funds for the National Green Hydrogen Mission, transmission systems for renewable energy, and battery energy storage systems reflects the government's commitment to sustainable development and reducing carbon emissions.

Education

The budget emphasized the importance of education by allocating funds for the hiring of teachers and support staff for Eklavya Model Residential Schools. The launch of the PM Kaushal Vikas Yojana 4.0 and the National Apprenticeship Promotion Scheme aims to enhance skill development and provide opportunities for the youth.

Financial Services

The financial services sector received attention in Budget 2024 through the revamping of credit guarantee schemes for MSMEs and the establishment of a unified IT system for registration and approval in the GIFT IFSC. These measures aim to streamline operations, facilitate growth, and attract investments in the financial sector.

Key Takeaways and Expectations

Budget 2024 introduced several direct and indirect tax reforms, focusing on making the new tax regime more attractive for taxpayers. The budget also prioritized inclusive development, infrastructure and investment, green growth, youth power, and the financial sector. The impact of the budget varied across industries, with significant measures introduced to support start-ups, MSMEs, co-operative societies, and various sectors like agriculture, healthcare, renewable energy, education, and financial services.

Looking ahead, taxpayers have certain expectations for future budgets. These include increasing the tax exemption limit, revising deductions like Section 80C and 80D, and reducing the surcharge rate for higher income earners. Salaried individuals hope for relief from the rising cost of living and the impact of inflation. Start-ups and MSMEs expect continued support to foster entrepreneurship and growth. The agricultural sector looks forward to increased investments and improved access to credit. The renewable energy sector hopes for a continued focus on green growth and sustainable development. Overall, citizens and businesses eagerly await future budgets that address their concerns and pave the way for a prosperous future.

In conclusion, Budget 2024 has set the stage for economic growth, sustainable development, and inclusive progress. The government's focus on key priorities and its commitment to various sectors reflect a vision for a resilient and prosperous India. As taxpayers and stakeholders, it is important to stay informed and engaged as we navigate the opportunities and challenges that lie ahead.