F-14/15, Orbit Mall, Civil Lines, Jaipur-302006

support@thetaxheaven.com

support@thetaxheaven.com

Summit Securities Limited, originally incorporated in 1997 as RPG Itochu Finance Limited, stands as one of India's unique investment holding companies with a massive portfolio worth over ₹12,878 crore concentrated in listed and unlisted securities. Operating as a Non-Banking Financial Company (NBFC) registered with the Reserve Bank of India, Summit represents a distinctive investment vehicle offering leveraged exposure to India's equity markets through its substantial holdings. In this comprehensive article, we analyze Summit Securities' share price targets from 2025 to 2030, supported by detailed business analysis, financial performance metrics, and expert investment guidance.

Let's explore the company's investment strategy, current market valuation, and future growth trajectory to understand its long-term investment potential.

| Detail | Value |

|---|---|

| Current Price | ₹2,222.20 |

| Previous Close | ₹2,220.90 |

| Day's High | ₹2,329.90 |

| Day's Low | ₹2,222.20 |

| 52-Week High | ₹3,675.00 |

| 52-Week Low | ₹1,380.00 |

| Market Capitalization | ₹2,480 Cr |

| Beta (Volatility) | 1.73 |

| Book Value per Share | ₹10,299.85 |

| Face Value | ₹10 |

| All Time High | ₹3,675.00 |

| All Time Low | ₹3.65 |

| VWAP | ₹2,280.71 |

Originally incorporated on January 30, 1997 as RPG Itochu Finance Limited under the Companies Act 1956, Summit Securities Limited obtained registration as a Non-Banking Finance Company from the Reserve Bank of India. Pursuant to a scheme of arrangement effective March 31, 2009, Summit Securities took over the entire assets and liabilities of the erstwhile Summit Securities Limited, CHI Investments Limited, Brabourne Enterprises Limited, and Octav Investments Limited.

Investment Holding Company Structure: Summit Securities operates primarily as an investment company with a varied portfolio consisting of both listed and unlisted companies, representing a pure-play vehicle for equity market exposure.

Massive Investment Portfolio: As of September 2025, the company holds investments worth ₹12,878 crore, representing virtually the entire asset base, with minimal fixed assets of only ₹0.01 crore, indicating a focused strategy on securities investment.

Exceptional Recent Performance: Q2 FY2026 results showcased explosive growth with consolidated net profit of ₹90.66 crore (up 20.64% YoY), net sales of ₹119.68 crore (up 12.19% YoY), and operating margins of 99.01%, demonstrating capital-light, highly profitable operations.

Remarkable Quarterly Turnaround: The company reported a dramatic reversal from a net loss of ₹4.64 crore in Q1 FY2026 to a net profit of ₹90.66 crore in Q2 FY2026, representing a 349.03% quarter-on-quarter surge, highlighting the transaction-driven nature of the business.

Stellar Long-Term Performance: Summit Securities has delivered exceptional 5-year stock price CAGR of 41%, 3-year CAGR of 54%, and 10-year CAGR of 21%, significantly outperforming broader market indices over extended periods.

Dividend Income Driven: The company's revenue structure is predominantly driven by dividend income, with Q2 FY2026 dividend income reaching ₹115.34 crore, supplemented by net gains on fair value changes and interest income.

Debt-Free Balance Sheet: Summit Securities maintains an impeccable zero-debt capital structure, providing financial flexibility and eliminating interest burden, with shareholder funds of ₹9,866.12 crore as of March 2025.

Extraordinary Book Value: The company's book value per share stands at an astonishing ₹10,299.85, yet the stock trades at merely ₹2,222, representing a massive 78% discount to book value and potentially indicating significant undervaluation.

Robust Reserve Growth: Reserves and surplus have grown dramatically from ₹5,094.92 crore in March 2023 to ₹9,855.22 crore in March 2025, representing 93.43% growth over two years, all funded through retained earnings.

Exceptional Profitability Metrics: The company achieved PAT margins of 75.75% in Q2 FY2026 and EPS of ₹83.17 for the quarter, among the highest in the financial services sector, reflecting the capital-light investment model.

| Investor Type | Holding (%) |

|---|---|

| Promoters | 74.65% |

| Retail & Others | 24.98% |

| Other Domestic Institutions | 0.30% |

| Foreign Institutions | 0.07% |

The promoter holding of 74.65% demonstrates strong management commitment and strategic control over the investment portfolio. However, the negligible institutional participation—with mutual funds and foreign institutions holding virtually nothing (0.37% combined)—suggests extremely limited professional investor interest, potentially creating opportunity or signaling concerns about the business model requiring careful analysis.

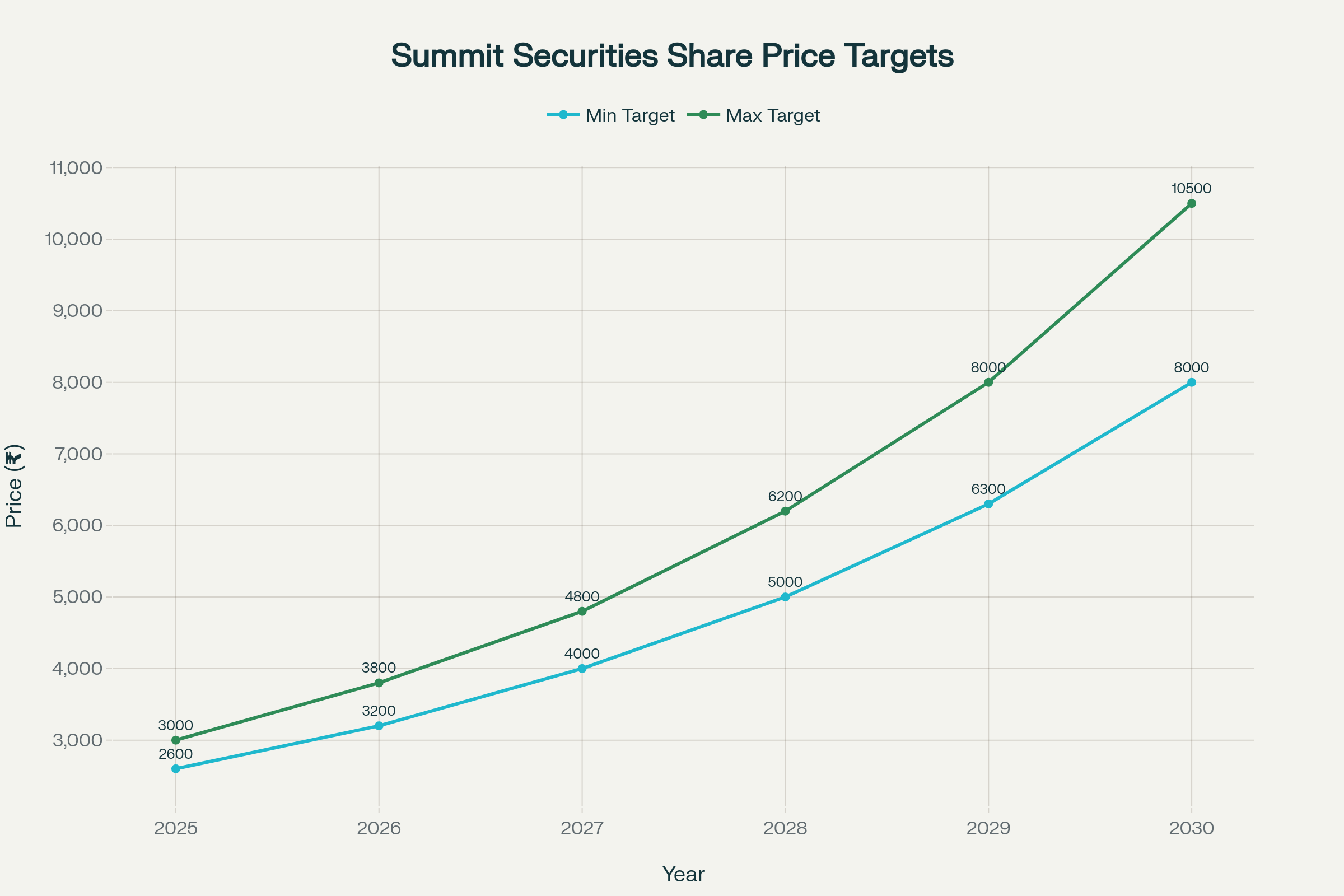

Projected share price targets for Summit Securities Ltd from 2025 to 2030, showing conservative and optimistic estimates

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2025 | 2,600 | 3,000 |

| 2026 | 3,200 | 3,800 |

| 2027 | 4,000 | 4,800 |

| 2028 | 5,000 | 6,200 |

| 2029 | 6,300 | 8,000 |

| 2030 | 8,000 | 10,500 |

These projections are based on the massive 78% discount to book value of ₹10,299.85 per share suggesting potential for valuation convergence, strong Q2 FY2026 performance with 20.64% profit growth and 99.01% operating margins, investment portfolio worth ₹12,878 crore providing leveraged exposure to India's equity market growth, and historical 5-year stock price CAGR of 41% and 3-year CAGR of 54% demonstrating strong appreciation potential.

By the end of 2025, Summit Securities' share price is expected to witness moderate recovery as investors recognize the extraordinary discount to book value and the company continues generating strong dividend income from its investment portfolio.

Why?

The stock is currently trading at merely 0.22 times book value of ₹10,299.85, representing an unprecedented 78% discount that suggests extreme undervaluation or market recognition of holding company discounts. Q2 FY2026 performance with consolidated profit of ₹90.66 crore (up 20.64% YoY) and operating margins of 99.01% demonstrates the highly profitable nature of the investment holding business model. The company's investment portfolio valued at ₹12,878 crore as of September 2025 (up from ₹11,360 crore in March 2025) indicates ongoing portfolio appreciation benefiting from India's buoyant equity markets. Historical performance shows Summit has delivered 445.66% returns over 5 years, significantly outperforming Sensex's returns during the same period, validating management's investment acumen.

Investment Advice: This represents a potentially attractive entry point for value investors with high risk tolerance who understand investment holding companies and can tolerate extreme volatility (beta of 1.73). The 78% discount to book value may appeal to contrarian investors, though understanding the reasons for this discount is critical. Systematic accumulation during corrections below ₹2,200 may provide favorable average prices, but position sizing should remain modest given the stock's unique characteristics and minimal liquidity.

In 2026, the stock could experience stronger momentum as partial convergence toward book value occurs and the company benefits from continued portfolio appreciation in India's growing equity markets.

Why?

India's equity markets are expected to continue strong performance driven by robust economic growth, rising domestic liquidity, and increasing investor participation, directly benefiting Summit's investment portfolio. The company's reserves and surplus growing from ₹9,855.22 crore in March 2025 demonstrates ongoing wealth creation through retained earnings, with book value per share likely to continue expanding. Summit's 10-year sales CAGR of 16% and profit CAGR of 12% indicate sustained ability to generate returns from its investment activities. The capital-light model with virtually zero fixed assets (₹0.01 crore) and zero debt provides maximum flexibility to deploy capital opportunistically across market cycles.

Investment Advice: Investors who entered during 2025 should maintain positions and evaluate adding during market corrections. Monitor the company's portfolio composition through annual reports to understand concentration risks and sectoral exposures. The lack of dividend payments despite strong profitability warrants attention—while this allows compounding through retained earnings, investors seeking income should look elsewhere.

By 2027, Summit Securities could witness significant price appreciation as the discount to book value narrows and the investment portfolio continues benefiting from India's long-term equity market growth trajectory.

Why?

The 3-year profit CAGR of 16% and revenue CAGR of 17% demonstrate consistent growth in the company's earning power from its investment activities. India's equity market capitalization is projected to continue expanding as the economy grows toward becoming a $5 trillion economy, creating wealth appreciation in Summit's substantial listed equity holdings. The company's operating profit margins consistently exceeding 98% across quarters highlight the extreme efficiency of the investment holding model with minimal operating expenses. Summit's 3-year stock price CAGR of 54% significantly outperformed broader markets, and while past performance doesn't guarantee future results, it demonstrates the stock's potential for substantial appreciation during favorable market conditions.

Investment Advice: Ideal holding for long-term value investors comfortable with volatility and the unique characteristics of investment holding companies. Evaluate whether the book value discount has begun narrowing—if the stock still trades at significant discounts despite strong fundamentals, reassess the structural reasons. Monitor for any corporate restructuring initiatives that could unlock shareholder value such as dividend distribution or partial monetization of holdings.

By 2028, the stock could potentially cross ₹5,000 as sustained portfolio appreciation and possible partial valuation convergence toward book value drive price increases.

Why?

The company's balance sheet strength with shareholder funds exceeding ₹9,866 crore and growing at nearly 93% over two years provides substantial intrinsic value cushion. India's transition to a $7-8 trillion economy by 2028-2030 should drive corporate earnings growth and equity market appreciation, directly benefiting investment holding companies like Summit. The company's historical 10-year stock price CAGR of 21% suggests that even conservative compounding would drive the stock significantly higher from current levels over a 3-4 year horizon. Summit's consistent profitability with FY2025 consolidated profit of ₹69 crore demonstrates ability to generate earnings through various market cycles.

Investment Advice: Suitable for portfolio allocation as a high-beta equity market play with leverage through the investment holding structure. Investors should evaluate actual returns delivered versus book value growth—if book value continues growing substantially faster than stock price, the discount may persist indefinitely due to structural holding company factors. Consider the potential for management to unlock value through strategic actions given the persistent discount.

A strong investment portfolio benefiting from India's sustained equity market growth combined with potential narrowing of the book value discount makes Summit an intriguing long-term speculation by 2029.

Why?

The company's demonstrated ability to grow reserves from ₹639 crore in March 2018 to ₹9,855 crore in March 2025 represents extraordinary wealth creation of 1,440% over seven years. India's equity markets are projected to be among the world's largest by 2030, and Summit's ₹12,878+ crore investment portfolio provides leveraged exposure to this growth story. The zero-debt structure eliminates financial risk and provides flexibility to navigate market downturns without forced selling pressure. Summit's 5-year stock price CAGR of 41% demonstrates that during favorable market conditions, the stock can deliver exceptional returns despite the holding company discount.

Investment Advice: This remains a high-risk, high-reward investment suitable only for aggressive investors who understand and accept extreme volatility (beta 1.73) and lack of liquidity. Monitor the company's portfolio transparency through disclosures—lack of detailed investment breakdowns makes risk assessment challenging. Evaluate whether institutional participation increases over time, as this would validate the investment thesis and improve liquidity.

By 2030, Summit Securities could potentially approach or even surpass its book value if investor recognition of the embedded value improves and the company's investment portfolio continues compounding wealth.

Why?

The book value per share of ₹10,299.85 growing at historical rates could exceed ₹15,000-20,000 by 2030, and even at persistent discounts, the stock price should appreciate proportionately. India becoming a developed economy with robust capital markets by 2030 should create substantial wealth in equity portfolios, directly benefiting investment holding companies. Summit's track record of 12% profit CAGR over 10 years demonstrates sustained ability to generate returns despite varying market conditions. The possibility of value-unlocking corporate actions increases over time as promoters and management may seek to address the persistent discount to book value through strategic initiatives.

Investment Advice: At this stage, investors should evaluate the stock based on achieved outcomes rather than projections. Assess whether the book value discount has meaningfully narrowed, whether the company has delivered portfolio growth matching or exceeding market indices, and whether any corporate restructuring has occurred to unlock value. Suitable only for investors who entered at significant discounts and can justify continued holding based on fundamental value rather than price momentum.

Highly Conditional. Summit Securities presents an extremely unique investment proposition—trading at a massive 78% discount to book value suggests either extraordinary undervaluation or structural issues inherent to investment holding companies that may prevent value realization. This is suitable only for sophisticated value investors with very high risk tolerance.

Extraordinary Discount to Book Value: Trading at merely 0.22 times book value of ₹10,299.85 per share represents one of the largest discounts in the Indian investment company universe, potentially offering asymmetric upside if any convergence occurs.

Massive Investment Portfolio: ₹12,878 crore investment portfolio as of September 2025 provides leveraged exposure to India's equity market growth, which is projected to remain among the world's fastest growing.

Exceptional Historical Performance: 5-year stock price CAGR of 41%, 3-year CAGR of 54%, and 10-year CAGR of 21% demonstrate the stock's ability to deliver substantial returns during favorable market periods.

Zero-Debt Balance Sheet: Complete absence of debt eliminates financial risk and provides maximum flexibility to navigate market cycles without forced liquidation pressure.

Dramatic Reserve Growth: Reserves and surplus growing from ₹5,095 crore in March 2023 to ₹9,855 crore in March 2025 (93% increase) demonstrates exceptional wealth creation through retained earnings and portfolio appreciation.

Highly Profitable Operations: Operating margins consistently exceeding 98-99% and PAT margins of 75% represent some of the highest profitability metrics in the financial sector, reflecting minimal operating costs.

Strong Recent Performance: Q2 FY2026 consolidated profit of ₹90.66 crore (up 20.64% YoY) with EPS of ₹83.17 demonstrates sustained earnings power.

Leveraged Equity Market Exposure: Investment holding structure provides retail investors a vehicle for concentrated equity market exposure without direct portfolio management responsibilities.

Extreme Volatility: Beta of 1.73 indicates the stock is 73% more volatile than broader markets, creating potential for severe drawdowns during market corrections.

Persistent Holding Company Discount: Trading at 78% discount to book value may be permanent due to structural factors including lack of control for minority shareholders, potential tax liabilities on investment sales, and management fees.

Zero Institutional Interest: Mutual funds holding 0%, foreign institutions 0.07%, and domestic institutions 0.30% suggests professional investors see significant issues or risks that aren't immediately apparent.

No Dividend Distribution: Despite strong profitability and ₹9,855 crore reserves, the company pays zero dividends, providing no income and forcing total reliance on potential capital appreciation.

Extreme Revenue Volatility: Quarterly sales ranging from ₹1 crore (Q4 FY25) to ₹119.68 crore (Q2 FY26)—a 120x variance—indicates unpredictable, lumpy revenue recognition making earnings forecasting impossible.

Very Low Liquidity: 20-day average volume of only 28,110 shares and average delivery of 23.91% suggests limited liquidity that could create challenges during exit attempts.

Opaque Portfolio Composition: Lack of detailed public disclosure about specific investments makes it impossible for minority shareholders to assess concentration risk, sectoral exposures, or portfolio quality.

Recent Sharp Decline: Stock down 39.5% from 52-week high of ₹3,675 to current ₹2,222, and year-to-date returns of -28.49% despite strong Q2 results suggests market concerns about sustainability.

Extremely Low Return Ratios: 3-year average ROE of only 0.90% and ROCE of 1.21% are exceptionally low, suggesting poor capital efficiency despite high profit margins.

Transaction-Dependent Earnings: The dramatic swing from ₹4.64 crore loss in Q1 FY2026 to ₹90.66 crore profit in Q2 FY2026 highlights dependence on sporadic, high-value transactions rather than recurring revenue.

Summit Securities Limited represents one of India's most enigmatic investment opportunities—a company with ₹12,878 crore investment portfolio and ₹10,299.85 book value per share trading at merely ₹2,222, representing a staggering 78% discount to book value. This extraordinary valuation disconnect creates either a compelling value investment opportunity or signals structural issues that may prevent value realization.

The company's recent operational performance has been exceptional. Q2 FY2026 delivered consolidated profit of ₹90.66 crore (up 20.64% YoY), operating margins of 99.01%, and PAT margins of 75.75%—metrics that rank among the highest in India's financial services sector. The zero-debt balance sheet with ₹9,855 crore reserves and surplus provides exceptional financial strength, while the dramatic reserves growth from ₹5,095 crore in March 2023 to ₹9,855 crore in March 2025 demonstrates sustained wealth creation.

The share price targets of ₹2,600-3,000 for 2025, scaling up to ₹8,000-10,500 by 2030, reflect potential scenarios where partial convergence toward book value occurs and the investment portfolio continues appreciating alongside India's equity market growth. Historical performance provides some validation—the stock has delivered 41% CAGR over five years, 54% over three years, and 21% over ten years, significantly outperforming broader indices during those periods.

However, investors must carefully consider why such an enormous discount persists. The virtually zero institutional participation (0.37% combined holdings from mutual funds, FIIs, and DIIs) suggests professional investors either don't understand the story or recognize issues that aren't immediately visible. The complete absence of dividends despite massive reserves, extremely low ROE of 0.90%, and wild quarterly earnings volatility (ranging from losses to ₹90+ crore profits) raise legitimate concerns about the business model's sustainability and value delivery to minority shareholders.

For investors considering Summit Securities, this should be viewed as a highly speculative, high-risk investment suitable only for those with exceptional risk tolerance, long investment horizons, and deep understanding of investment holding company dynamics. The stock's beta of 1.73 indicates extreme volatility that could result in severe paper losses during market downturns, while the minimal liquidity (28,110 average daily volume) could make exit difficult.

The investment case essentially bets on either: (1) gradual convergence toward book value as investors recognize embedded value, (2) corporate actions by management to unlock value through restructuring, dividends, or stake sales, or (3) continued strong portfolio appreciation that eventually forces market recognition despite structural discounts. Conversely, the discount could persist or even widen if the portfolio underperforms markets, corporate governance concerns emerge, or holding company structures fall further out of favor.

Conservative investors should avoid Summit Securities entirely given the complexity, volatility, and lack of institutional validation. Aggressive value investors willing to accept extreme volatility might consider small speculative positions at current levels (representing 78% discount to book value), but should never make this a core portfolio holding. The decision ultimately depends on individual conviction about India's long-term equity market growth, belief in eventual value convergence mechanisms, and personal tolerance for potentially permanent capital impairment if the structural discount proves irreversible.

Stay updated with quarterly results to monitor portfolio value changes and earnings trends, review annual reports for portfolio composition details when disclosed, watch for any corporate action announcements regarding dividends, restructuring, or stake monetization, and track whether institutional participation begins to increase as a validation signal for the investment thesis.

The immediate price target for Summit Securities ranges between ₹2,600-3,000 for 2025, with medium-term targets of ₹4,000-4,800 by 2027 and long-term potential of ₹8,000-10,500 by 2030, based on potential partial convergence toward the massive book value of ₹10,299.85 per share and continued investment portfolio appreciation.

Summit Securities represents an extremely high-risk, high-reward speculation suitable only for sophisticated value investors. Trading at 78% discount to book value suggests potential upside, but zero institutional participation, no dividends, extreme volatility (beta 1.73), and wild earnings swings indicate substantial risks requiring very careful analysis.

The future outlook depends on India's equity market performance (which should drive the ₹12,878 crore investment portfolio's value), potential narrowing of the 78% discount to book value, and possible corporate actions to unlock shareholder value. Recent Q2 FY2026 performance with 20.64% profit growth is positive, but extreme quarterly volatility makes forecasting challenging.

Analysts and market projections suggest a price target range of ₹2,600-3,000 for Summit Securities by the end of 2025, reflecting potential for modest recovery from current levels as investors recognize the extraordinary book value discount and strong Q2 FY2026 operational performance.

As of October 17, 2025, Summit Securities share price is ₹2,222.20 on the NSE, trading near its previous close of ₹2,220.90. The 52-week range is ₹1,380.00 to ₹3,675.00 (which is also the all-time high), indicating the stock is currently down about 39.5% from its peak.

The current price of ₹2,222 represents a massive 78% discount to book value of ₹10,299.85, which could appeal to value investors. However, the 39.5% decline from 52-week highs despite strong Q2 results, zero institutional ownership, and extreme volatility suggest this is suitable only for aggressive speculators willing to accept substantial risk.

Investment in Summit Securities should only be considered by sophisticated investors who deeply understand investment holding companies, can tolerate extreme volatility (beta 1.73), accept zero dividend income, and are comfortable with very low liquidity. This should never represent more than a small speculative allocation in a diversified portfolio given the unique risks.

Summit Securities has increased approximately 61% from its 52-week low of ₹1,380 to the current price of around ₹2,222, though it remains about 39.5% below its 52-week and all-time high of ₹3,675, demonstrating the extreme price volatility characteristic of this stock.

You can invest in Summit Securities by opening a demat and trading account with a registered stockbroker, completing KYC requirements, funding your account, and purchasing shares through NSE or BSE where the stock is listed under symbol SUMMITSEC. However, be aware of very limited daily liquidity with average volume of only 28,110 shares.

As of October 2025, Summit Securities' shareholding pattern shows Promoters holding 74.65%, Retail and Others holding 24.98%, Other Domestic Institutions holding 0.30%, and Foreign Institutions holding 0.07%, with virtually zero mutual fund participation, indicating minimal institutional interest.

Disclaimer: This article is for educational and informational purposes only and should not be construed as financial advice or investment recommendation. Investment in equity markets involves substantial risk of capital loss. Summit Securities represents an extremely high-risk, high-volatility investment with unique characteristics that make it suitable only for sophisticated investors with exceptional risk tolerance. The share price targets mentioned are speculative projections based on assumptions about book value convergence that may never materialize. The 78% discount to book value may be permanent due to structural holding company factors, lack of liquidity, governance concerns, or portfolio composition issues. Past performance including 41% five-year CAGR does not guarantee future results. The extreme quarterly earnings volatility, zero institutional participation, absence of dividends, very low ROE of 0.90%, and high beta of 1.73 represent significant risk factors. The lack of detailed portfolio disclosure makes comprehensive risk assessment impossible. Investors could experience complete or near-complete capital loss. The minimal daily trading volume creates substantial liquidity risk making exit difficult. Readers are strongly urged to conduct exhaustive due diligence, review official company filings, understand the specific risks of investment holding companies, never invest more than they can afford to lose entirely, and consult with qualified financial advisors who understand complex investment structures before making any investment decisions. The author and publisher assume no liability for any financial losses, damages, or adverse consequences incurred based on information, analysis, or projections presented in this article. This security should be considered only as a small speculative position within a well-diversified portfolio, if at all.