F-14/15, Orbit Mall, Civil Lines, Jaipur-302006

support@thetaxheaven.com

support@thetaxheaven.com

Sasta Sundar Ventures Limited, a pioneering player in India's digital healthcare ecosystem, is transforming how millions access affordable medicines and healthcare services. Operating in the rapidly expanding e-pharmacy and healthcare technology sector, the company has positioned itself as a key beneficiary of India's healthcare digitization revolution. In this comprehensive article, we analyze Sasta Sundar Ventures' share price targets from 2025 to 2030, supported by detailed financial analysis, business fundamentals, and expert investment guidance.

Let's explore the company's business model, current market position, and future growth trajectory to understand its investment potential.

| Detail | Value |

|---|---|

| Current Price | ₹308.10 |

| Previous Close | ₹310.00 |

| Day's High | ₹315.00 |

| Day's Low | ₹308.00 |

| 52-Week High | ₹381.70 |

| 52-Week Low | ₹205.00 |

| Market Capitalization | ₹989 Cr |

| Beta (Volatility) | 0.83 |

| Book Value per Share | ₹216.50 |

| Face Value | ₹10 |

| All Time High | ₹580.00 |

| All Time Low | ₹17.05 |

| VWAP | ₹310.55 |

Founded in 1989 and incorporated as a digital healthcare platform operator, Sasta Sundar Ventures Limited has emerged as a significant player in India's healthcare e-commerce sector. The company operates through two primary business segments: Financial Services and Healthcare Network, with the latter forming the substantial part of its operations.

Digital Healthcare Platforms: Sasta Sundar Ventures operates multiple digital platforms including the SastaSundar Application, a consumer-focused platform offering pharmacy, diagnostics, and wellness services, and RetailerShakti.com, a B2B digital platform for pharmaceutical and wellness products.

Market Position: The company serves as a bridge between online and offline healthcare delivery, combining digital efficiency with personal care through its network of physical counseling centers called "Healthbuddies".

Strategic Transformation: In 2025, the company ended its partnership with Flipkart Health and relaunched its B2C platform under its own brand, demonstrating strategic independence and control over its business model.

Ambitious Growth Targets: Management has set an aggressive revenue target of ₹6,600 crore by 2030, representing a nearly 5x increase from current trailing twelve-month sales of approximately ₹1,225 crore.

Technology Investment: The company is investing ₹150 crore over two years to strengthen its digital healthcare platform, warehousing infrastructure, and AI-driven healthcare tools.

Product Innovation: Launch of JITO, a curated generics medicine channel, targets the growing demand for affordable quality-verified generic medications.

| Investor Type | Holding (%) |

|---|---|

| Promoters | 74.24% |

| Retail & Others | 21.79% |

| Other Domestic Institutions | 2.09% |

| Foreign Institutions | 1.88% |

The high promoter holding of 74.24% demonstrates strong management confidence and commitment to the company's long-term vision. However, the relatively low institutional participation at 3.97% combined suggests limited institutional investor interest, which could change as the company demonstrates consistent profitability.

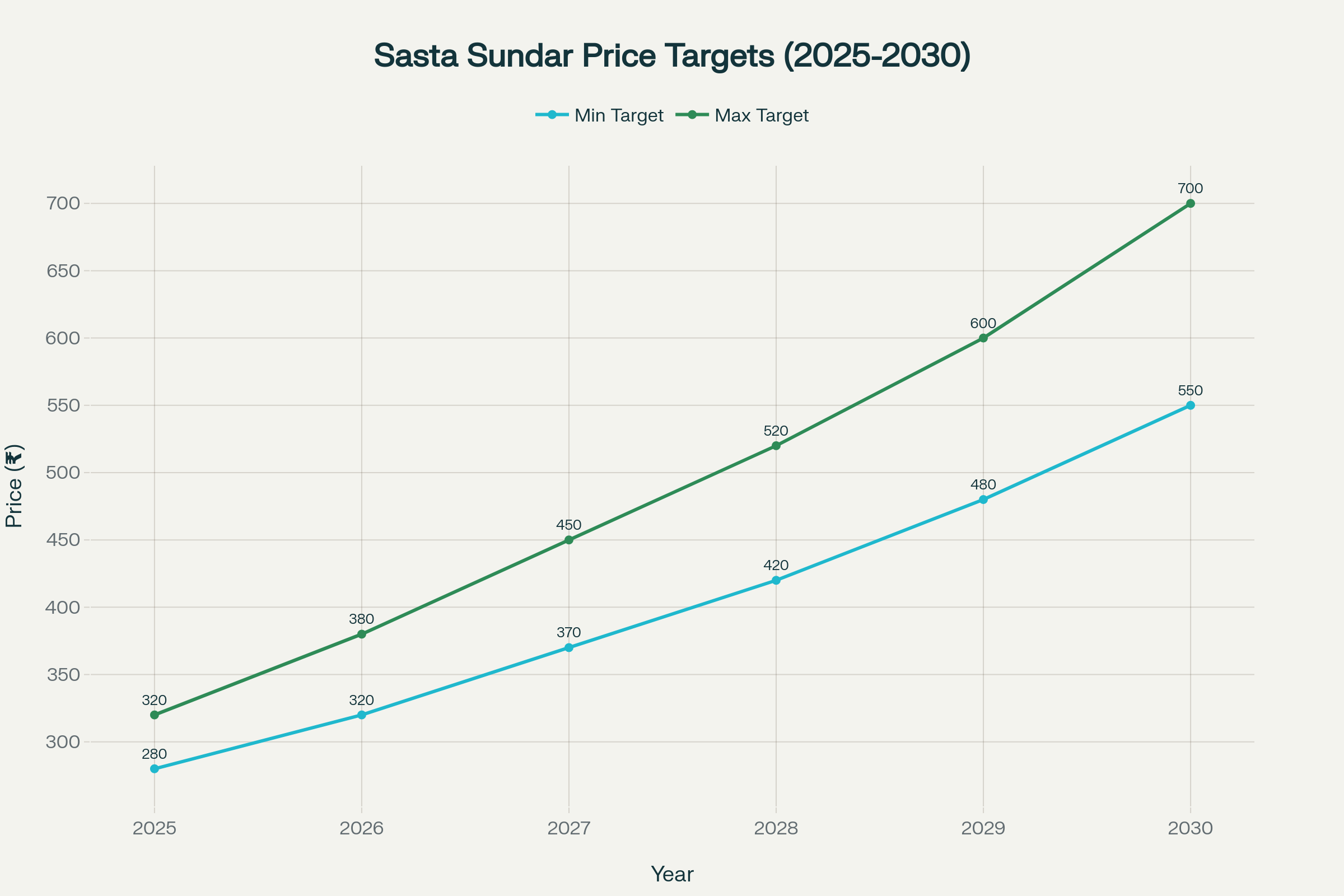

Projected share price targets for Sasta Sundar Ventures Ltd from 2025 to 2030, showing conservative and optimistic estimates

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2025 | 280 | 320 |

| 2026 | 320 | 380 |

| 2027 | 370 | 450 |

| 2028 | 420 | 520 |

| 2029 | 480 | 600 |

| 2030 | 550 | 700 |

These projections are based on Sasta Sundar Ventures' ambitious growth plans, the company's strategic investments in technology and infrastructure, India's expanding e-pharmacy market, and the broader healthcare digitization trends.

By the end of 2025, Sasta Sundar Ventures' share price is expected to trade within a consolidation range as the company navigates its post-Flipkart transition phase and works toward achieving profitability in FY26.

Why?

The company is targeting a return to net profit in FY26 after recording a ₹122 crore net loss in FY25, requiring successful execution of strategic initiatives. On the positive side, RetailerShakti's B2B business delivered strong performance with revenue nearly doubling to ₹941 crore in FY25, providing a solid foundation. The deployment of ₹40 crore in FY25 from the ₹150 crore investment pool is expected to start showing initial results. However, the company faces headwinds from revenue de-growth, with total revenue declining to approximately ₹1,191 crore projected for FY25 from ₹1,352 crore in FY24.

Investment Advice: This year represents a transition period for the company. Conservative investors should wait for clear signs of profitability before initiating positions. Aggressive investors with high risk tolerance may consider small accumulation during price corrections below ₹290, but overall portfolio exposure should remain minimal.

In 2026, the stock could witness moderate appreciation as the company's strategic investments begin yielding tangible results and the path to sustainable profitability becomes clearer.

Why?

The targeted doubling of B2C business from ₹144 crore achieved in FY25, supported by ₹50 crore investment in technology and AI-driven healthcare tools, should drive top-line growth. RetailerShakti is expected to achieve EBITDA breakeven in Q4 FY26, marking a crucial milestone for the B2B segment's profitability. The expansion of Healthbuddies network from 250 to approximately 400 by end of FY26 will strengthen the company's distribution capabilities. Additionally, the JITO platform, backed by ₹25 crore investment, should gain market traction in the growing generics segment.

Investment Advice: Monitor quarterly results closely, particularly Q4 FY26 results for evidence of EBITDA breakeven in RetailerShakti. Investors can consider initiating positions if the company demonstrates revenue stabilization and improving margins. Maintain sector allocation within recommended limits.

By 2027, Sasta Sundar Ventures could experience significant upward momentum as the company establishes itself as a profitable digital healthcare platform with demonstrated execution capabilities.

Why?

The completion of the ₹150 crore investment program by FY27 should result in a fully modernized technology platform and expanded infrastructure. India's e-pharmacy market is projected to continue rapid growth, with the broader healthcare e-commerce sector expected to expand at a CAGR of approximately 20-25%. The company's dual platform strategy (B2C and B2B) provides diversified revenue streams and reduces business risk. Achievement of positive EBITDA margins should attract greater institutional investor interest, potentially leading to valuation re-rating.

Investment Advice: This could be an optimal entry point for medium to long-term investors if the company has demonstrated consistent profitability for at least two consecutive quarters. Consider systematic investment plans to average acquisition costs and reduce timing risk.

By 2028, the stock could comfortably cross the ₹500 mark as the company matures into a stable, cash-generating digital healthcare platform with proven business economics.

Why?

Progress toward the ₹6,600 crore revenue target by 2030 should be clearly visible, with revenues potentially exceeding ₹3,000-3,500 crore by this stage. The company's targeted blended EBITDA margin of 4-5% by FY30 should start materializing, significantly improving profitability metrics. Enhanced operating leverage from established technology infrastructure and distribution network will drive margin expansion. Growing market share in India's rapidly expanding healthcare digitization ecosystem positions the company for sustained growth.

Investment Advice: Ideal for portfolio core holdings if financial performance meets expectations. Long-term investors should maintain positions and consider adding during temporary market corrections. Monitor competitive landscape developments closely.

A strong position in both B2C and B2B healthcare commerce, combined with demonstrated profitability, makes Sasta Sundar Ventures an attractive long-term investment by 2029.

Why?

The company should be approaching its ₹6,600 crore revenue target, with revenues potentially reaching ₹5,000-5,500 crore. Established brand recognition in affordable healthcare and generics positioning strengthens competitive moats. Potential for dividend distribution becomes realistic as cash flows strengthen and capital allocation priorities shift. The broader Indian healthcare sector is expected to exceed $610 billion by this timeframe, providing substantial market opportunity.

Investment Advice: Excellent holding for wealth creation in long-term portfolios. Investors should evaluate whether to book partial profits or continue holding based on individual financial goals and the company's relative valuation compared to peers.

By 2030, Sasta Sundar Ventures may emerge as one of India's leading digital healthcare platforms, potentially commanding premium valuations if it successfully executes its ambitious growth strategy.

Why?

Achievement or near-achievement of the ₹6,600 crore revenue target would represent a remarkable growth journey. Targeted EBITDA margins of 4-5% on this revenue base would translate to healthy absolute profitability. The company's early-mover advantage in combining e-pharmacy with B2B pharmaceutical distribution creates a unique business model. India's healthcare digitization mega-trend, supported by government initiatives like the National Digital Health Mission, provides long-term tailwinds.

Investment Advice: At this stage, investors should evaluate the stock based on achieved fundamentals rather than projections. Consider whether valuations remain reasonable relative to earnings, cash flows, and growth prospects. Suitable for long-term wealth preservation and growth if the company has delivered on its strategic roadmap.

Conditional Yes. Sasta Sundar Ventures presents a high-risk, high-reward investment opportunity suitable for investors with strong risk appetite and long investment horizons.

Massive Market Opportunity: India's healthcare e-commerce market generated approximately $3,859 million in 2024 and is expected to grow at 20-25% annually. The digital health market could unlock over $200 billion in economic value by 2034.

Strategic Business Model: The dual-platform approach combining B2C (SastaSundar) and B2B (RetailerShakti) provides diversification and multiple growth levers.

Aggressive Growth Ambitions: Management's target of ₹6,600 crore revenue by 2030 demonstrates bold vision and commitment to scale.

Significant Investment in Technology: The ₹150 crore investment in AI, technology, and infrastructure positions the company for future competitiveness.

Affordable Healthcare Focus: Concentration on generics and affordable medicines aligns with India's healthcare accessibility goals and government policy support.

Post-Flipkart Independence: Full control over the B2C platform enables better strategic flexibility and capture of complete value chain economics.

Recent Financial Losses: The company reported a net loss of ₹122 crore in FY25, with negative ROCE of -28.4%, indicating significant operational challenges.

Revenue Volatility: Revenue declined from ₹1,376 crore in March 2025 to projected ₹1,191 crore in FY25, showing business instability during the transition period.

Execution Risk: Achieving the ambitious ₹6,600 crore revenue target requires flawless execution across multiple business initiatives simultaneously.

Competitive Intensity: The company faces formidable competition from well-funded players like PharmEasy, 1mg, Netmeds, and deep-pocketed e-commerce giants.

Regulatory Uncertainty: E-pharmacy regulations in India continue to evolve, potentially impacting business models and operating parameters.

Low Institutional Interest: Domestic mutual funds hold only 0% of the company, suggesting professional investors remain unconvinced about current valuations or business prospects.

High Valuation Relative to Fundamentals: With negative TTM earnings, traditional valuation metrics like P/E ratio are not applicable, making valuation assessment challenging.

Dependence on Capital Deployment: Success heavily depends on effective deployment of the ₹150 crore investment and achievement of targeted returns.

Sasta Sundar Ventures Limited stands at a critical inflection point in its corporate journey. After ending its Flipkart partnership and charting an independent path, the company is making substantial investments to build a comprehensive digital healthcare platform targeting exponential growth over the next five years.

Currently trading at approximately ₹308, the stock presents a speculative investment opportunity rather than a conservative value play. The company's ambitious revenue target of ₹6,600 crore by 2030—representing nearly 5x growth from current levels—could potentially drive the share price toward ₹550-700 if successfully executed. However, investors must carefully weigh this growth potential against significant near-term challenges including recent financial losses, revenue volatility, and the need to demonstrate sustainable profitability.

The Indian healthcare e-commerce sector offers tremendous long-term growth potential, with projections indicating the market could reach $5.4 billion in telemedicine alone by 2025 and unlock over $200 billion in total economic value by 2034. Sasta Sundar Ventures is strategically positioned to capture a meaningful share of this opportunity through its dual B2C and B2B platforms, focus on affordable generics, and significant technology investments.

For investors considering Sasta Sundar Ventures, the key is timing and risk management. The stock is most suitable for aggressive investors willing to accept high volatility and potential capital loss in exchange for the possibility of substantial long-term gains if the company successfully executes its transformation strategy. Conservative investors should wait for at least two to three consecutive quarters of demonstrated profitability and revenue stabilization before initiating positions.

Stay updated with quarterly earnings reports, monitor progress against the ₹6,600 crore revenue target, and track competitive developments in India's rapidly evolving healthcare digitization landscape for strategic entry and exit decisions.

The immediate price target for Sasta Sundar Ventures ranges between ₹280-320 for 2025, with medium-term targets of ₹370-450 by 2027 and long-term potential of ₹550-700 by 2030, depending on successful execution of the company's strategic initiatives and achievement of profitability goals.

Currently, Sasta Sundar Ventures represents a high-risk speculative investment suitable primarily for aggressive investors. The company is in a transition phase with recent financial losses but significant growth investments. Conservative investors should wait for demonstrated profitability, while risk-tolerant investors might consider small positions during price corrections.

The future outlook is cautiously optimistic based on India's rapidly growing healthcare e-commerce market, the company's ₹150 crore technology investment, ambitious ₹6,600 crore revenue target by 2030, and strategic focus on affordable healthcare. However, success depends heavily on execution capabilities and achieving sustainable profitability.

Analysts and market projections suggest a price target range of ₹280-320 for Sasta Sundar Ventures by the end of 2025, reflecting the company's transition period as it works toward achieving profitability in FY26 while managing post-Flipkart business restructuring.

As of October 17, 2025, Sasta Sundar Ventures share price is ₹308.10 on the NSE, with the stock trading near its previous close of ₹310.00. The 52-week range is ₹205.00 to ₹381.70, indicating significant volatility.

The current period represents a transitional phase with mixed signals. The stock offers potential long-term value if the company executes its turnaround strategy successfully, but near-term risks remain elevated due to recent losses and revenue challenges. Timing should align with individual risk tolerance and investment horizon.

Investment in Sasta Sundar Ventures should be based on high risk tolerance, long investment horizon, and conviction in India's healthcare digitization story. The stock is suitable for a small allocation in diversified portfolios for aggressive growth-oriented investors, but not recommended as a core holding for conservative investors.

Sasta Sundar Ventures has increased approximately 50% from its 52-week low of ₹205.00 to the current price of around ₹308, though it remains about 19% below its 52-week high of ₹381.70, indicating significant price volatility.

You can invest in Sasta Sundar Ventures by opening a demat and trading account with a registered stockbroker, completing KYC formalities, funding your trading account, and purchasing shares through NSE or BSE where the stock is listed under the symbol SASTASUNDR.

As of October 2025, Sasta Sundar Ventures' shareholding pattern shows Promoters holding 74.24%, Retail and Others holding 21.79%, Other Domestic Institutions holding 2.09%, and Foreign Institutions holding 1.88%, indicating strong promoter control but limited institutional participation.

Disclaimer: This article is for educational and informational purposes only and should not be construed as financial advice. Investment in equity markets involves substantial risk of loss. The share price targets mentioned are projections based on current information and assumptions, which may change materially. Past performance does not guarantee future results. Readers are strongly advised to conduct their own thorough research and consult with qualified financial advisors before making any investment decisions. The author and publisher assume no liability for any financial losses incurred based on information presented in this article.