Income Tax Return (ITR) Filing Last Date 2023

The final date for filing Income Tax Returns (ITR) for FY 2022-23 (AY 2023-24) without incurring late fees is July 31, 2023, specifically for Indian taxpayers.

Should you miss this deadline, it's essential to note that there will be additional financial implications. Taxpayers filing their returns after this due date will be subject to interest charges under Section 234A and penalties as prescribed under Section 234F of the Income Tax Act.

Therefore, timely filing is crucial to avoid these additional charges and maintain compliance with Indian tax regulations.

Latest Update for ITR filing Date:

The original deadline to file ITR-7, Form 10B, and Form 10BB was September 30, 2023. Now, this due date has been extended to October 31, 2023. Taxpayers can now submit these forms by the revised date to meet the updated filing requirements.

What is the Deadline for ITR Filing?

The deadline for filing ITR for Financial Year 2022-23 (AY 2023-24) was July 31, 2023. If missed, a belated return can still be filed until December 31, 2023.

For the upcoming tax season of Financial Year 2023-24 (AY 2024-25), the last date for ITR filing is July 31, 2024.

About the Financial Year (FY) and Assessment Year (AY)

The return you'll file in the upcoming year concerns the income you earned during FY 2023-24, covering earnings from April 1, 2023, to March 31, 2024. The assessment year, involving return filings and investment declarations for tax assessment, relates to the review period for FY 2023-24.

Consequently, the assessment year would be the subsequent year, encompassing April 1, 2024, to March 31, 2025, identified as AY 2024-25.

Important to File Income Tax Returns on Time

Meeting the deadline for filing income tax returns isn't just a task; it's a responsibility laid down by the government. It's crucial for everyone to play their part by honestly reporting their income, claiming deductions, and paying the correct taxes on time. Doing so doesn't just comply with the law; it helps the government effectively collect taxes, ensuring better public services and community welfare. It's our contribution to the nation's growth!

Start Date for Filing Income Tax Returns (ITR) 2023

E-filing for Income Tax Return (ITR) AY 2024-25 (FY 2023-24) has commenced. Delve into the details about the last filing date for FY 2023-24 below.

Income Tax Filing due dates for FY 2023-24 (AY 2024-25)

|

Category of Taxpayer |

Due Date for Tax Filing - FY 2023-24 *(unless extended) |

|

Individual / HUF/ AOP/ BOI (books of accounts not required to be audited) |

31st July 2024 |

|

Businesses (Requiring Audit) |

31st October 2024 |

|

Businesses requiring transfer pricing reports (in case of international/specified domestic transactions) |

30th November 2024 |

|

Revised return |

31 December 2024 |

|

Belated/late return |

31 December 2024 |

What Happens if You Miss the Income Tax Return (ITR) Filing Deadline?

- Interest: Late filing of Income Tax Returns (ITRs) in India leads to interest charges levied under Section 234A of the Income Tax Act, 1961. The interest is calculated at a rate of 1% per month or part thereof on the due tax amount until the return is filed. This accrued interest must be paid along with the tax liabilities.

- Late Fee: Taxpayers failing to file their ITR within the due date (usually July 31st) but submitting it before December 31st face a penalty of up to ₹5,000. For returns filed after December 31st, the penalty can go up to ₹10,000. However, if the taxpayer's total income does not exceed ₹5 lakh, the maximum penalty is limited to ₹1,000.

- Loss Adjustment: Delayed filing affects loss adjustments. Taxpayers are unable to carry forward certain losses, such as business losses or capital losses, for set-off in subsequent years if the return is not filed within the due date.

- Belated Return: A return filed after the due date is considered a belated return. Such returns have limitations. For instance, one cannot revise a belated return, restricting opportunities for corrections or adjustments in the original filing.

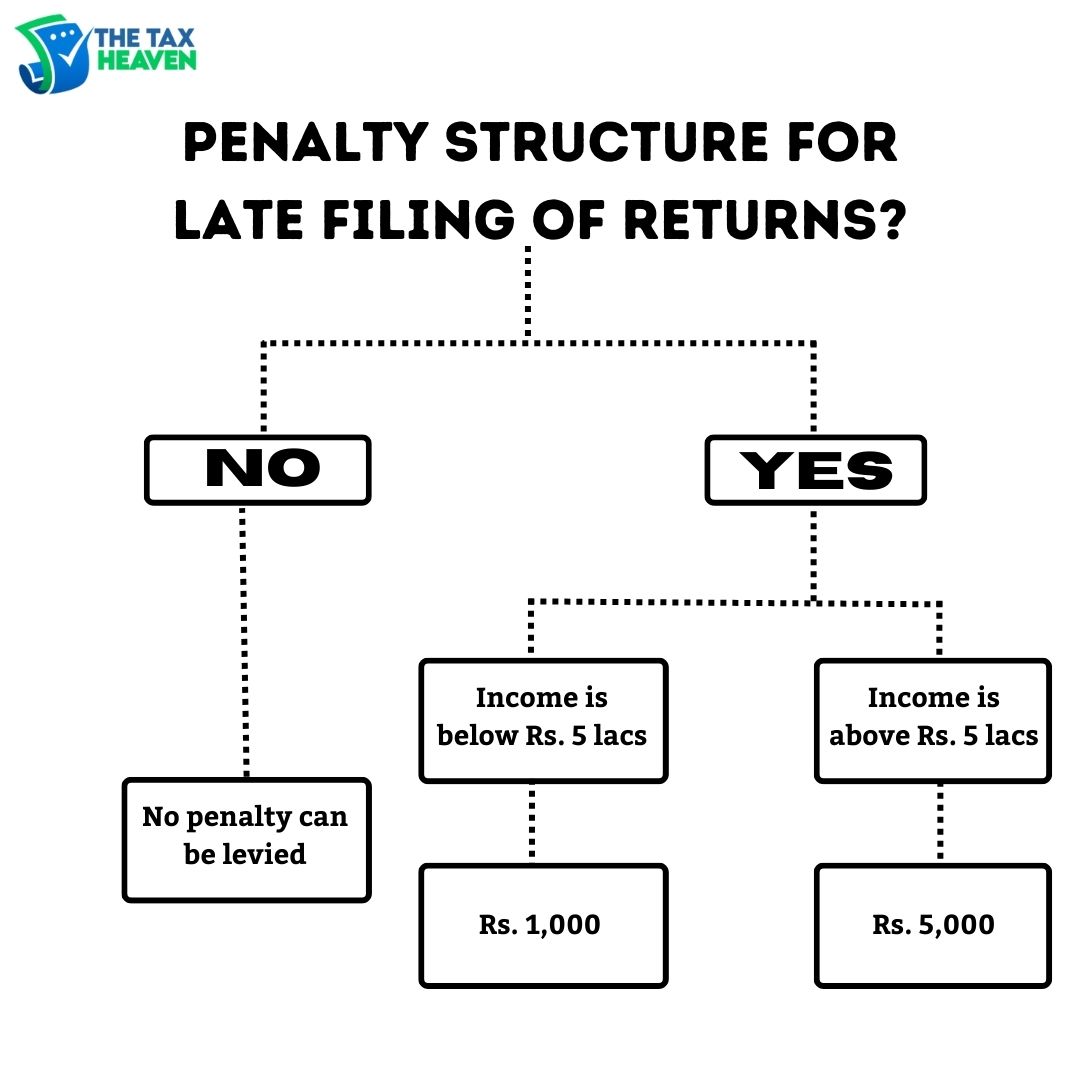

What is the interest and penalty structure for late filing of returns?

| Particulars | Amount of penalty and Interest | Section of the Act |

| Delay in filing Income Tax Return |

For FY 2022-23(AY 2023-2024 Penalty - when the total income of the person exceeds INR 5 Lakhs: Rs.5,000 - any other case: Rs. 1,000 Interest - 1% per month or part month on the unpaid tax amount under Section 234A if you file your return after the due date. |

234F |

| Late filing of TDS return |

Fee: INR 200 per day from the due date of filing till the date of filing such return. Such penalty shall not exceed the TDS amount. Penalty: Minimum INR 10,000 and maximum INR 1,00,000 No penalty if the return is filed within one year from the due date |

234E 271H |

Discover an interesting fact: You might still receive a refund even if you file your ITR after the due date! Don't let your money slip away. The Tax Heaven is here to help you grab every possible deduction and optimize your refund. Reclaim your hard-earned money by seeking assistance from our online CAs to boost your savings!

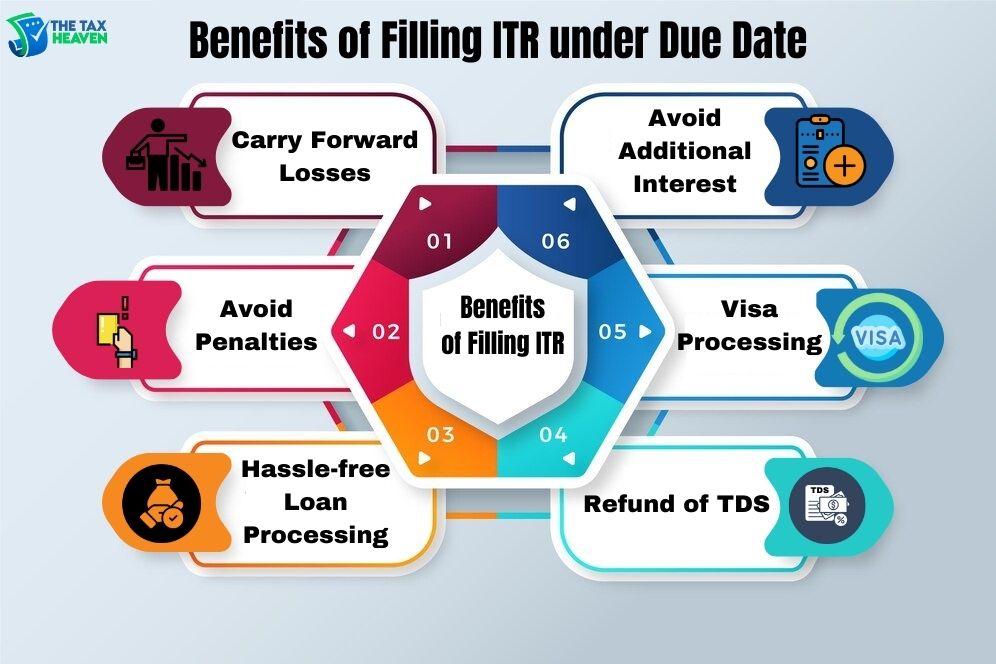

Benefits of Filling ITR under Due Date

The following are the advances of ITR filing before the due date:

- Compliance: Timely filing ensures adherence to tax laws, avoiding penalties.

- Financial Credibility: Showcases financial stability for easier loan processing.

- Quicker Refunds: Expedited processing leads to faster refunds, if eligible.

- Proof of Income: Essential documentation for financial transactions and visa applications.

- Error Rectification: Allows ample time for rectifications or amendments, if needed.

- Efficient Tax Planning: Facilitates better planning for the upcoming financial year, ensuring smooth financial management.

Not sure whether you should file an income tax return? Read our article. Use The Tax Heaven to e-file your IT return right away!

- Easily upload Form 16 on The Tax Heaven for automated return preparation and swift e-filing within minutes.

- We simplifie ITR-4 e-filing for Section 44AD or 44ADA ventures like Kirana stores or e-commerce.

- Our platform offers CA-assisted plans for efficient preparation and filing by skilled professionals.

- The Tax Heaven intelligently selects the appropriate ITR form, supporting ITR-1 to ITR-7 for seamless filing.