Introduction

Receiving an income tax notice can be a daunting experience for individuals and businesses alike. It is essential to understand the purpose and implications of such notices to ensure compliance with the Income Tax Act. One such notice is sent under Section 156 of the Income Tax Act, which addresses outstanding tax demands. In this article, we will delve into the details of Section 156 and provide insights on how to respond to an income tax notice, the time limit for response, and the consequences of delay.

What is Section 156?

Section 156 of the Income Tax Act empowers the Assessing Officer (A.O.) to issue a notice of demand when any tax, interest, penalty, fine, or other sums are payable by the taxpayer as a result of an order passed under the Income Tax Act. The notice specifies the amount due and the deadline for payment, typically within 30 days from the receipt of the notice.

It is important to note that notices for sum payable under Section 143(1), 200A(1), and 206CB(1) are also treated as notices of demand under Section 156.

Read More:- Income Tax Notice: How to Check and Authenticate?

How to Respond to an Outstanding Demand Notice?

When you receive an outstanding demand notice under Section 156, you have the option to either agree or disagree with the demand. The Income Tax Department provides a streamlined process for responding to such notices through the income tax e-filing portal. Here are the steps to follow:

- Demand is correct.

- The demand is partially correct.

- Disagree with demand.

- Demand is not correct but agrees to adjustment

Step 1: Login to your Income Tax e-filing portal and enter your User ID and Password.

.png)

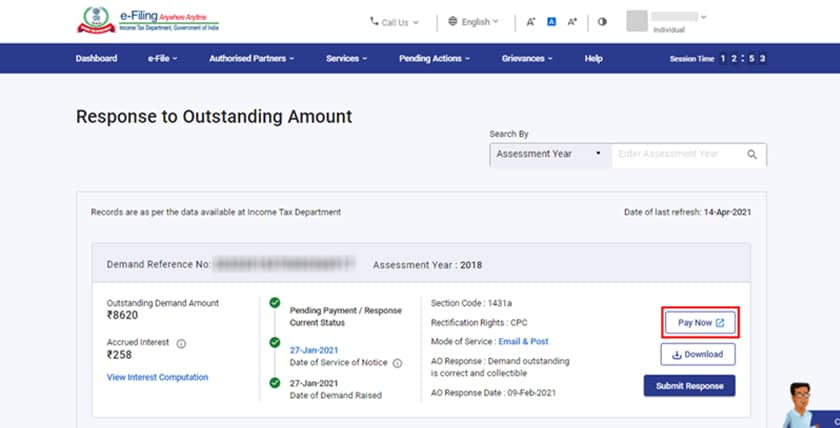

Step 2 : Select the option of Pending Actions-> Response to Outstanding Tax Demand

Step 3 : Click on submit response

Step 4 : The options discussed above will be displayed on the screen that is provided below when you proceed to the following step.

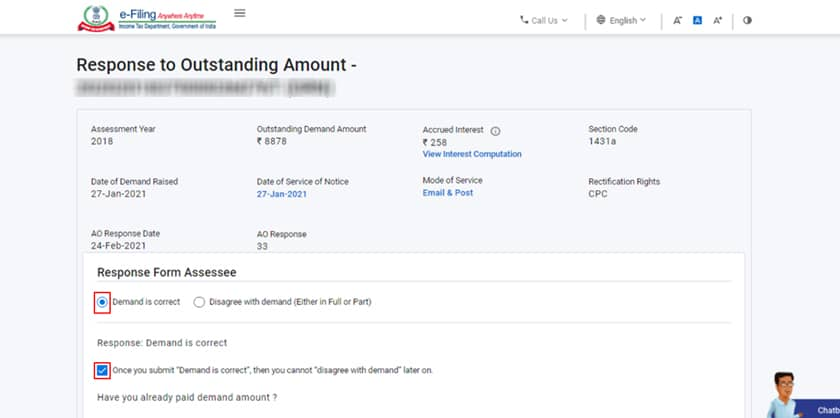

Option 1: Agreeing with the Demand

Select the Demand is Correct option and the disclaimer on the Response to Outstanding Amount page if you concur with the demand. As stated here: "Once you submit the response as "Demand is correct," then you cannot later disagree with Demand."-

Choose the Not paid yet option on the same page, then click Pay Now to be directed to the e-Pay Tax website, where you can pay the tax. On successful payment, a message of success and a Transaction ID are shown. Please remember the Transaction ID for reference in the future.

Select Yes, Already paid, and Challan has CIN if the demand has already been paid. To add challan details, click.

Choose Type of Payment (minor head), enter the challan amount, BSR code, serial number, choose the date of payment, and optionally add remarks to add the challan data. To upload a copy of the challan, choose Attachment (which can be in application or pdf format), then click Save.

NOTE:-

- A single attachment should not exceed 5 MB in size.

- If you need to upload several documents, zip the folder up first. Then upload the folder. A zipped folder's total attachment size shouldn't exceed 50 MB.

Click Submit to submit the response and the challan details after providing the necessary information.

.jpg)

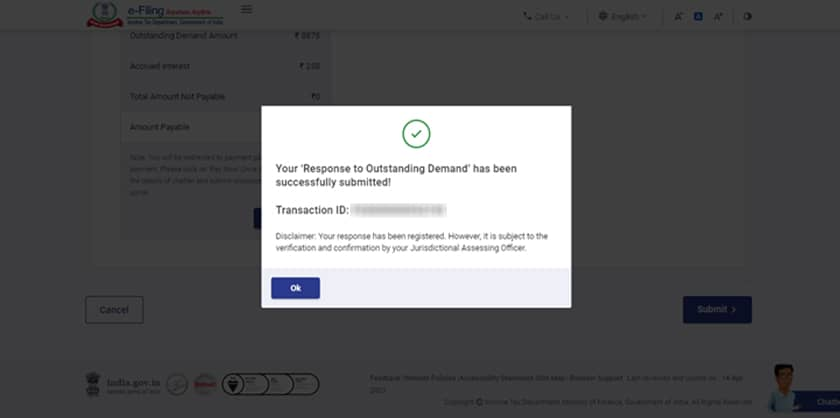

A success message and a Transaction ID are shown after the validation is accomplished. Please remember the Transaction ID as displayed above for future use.

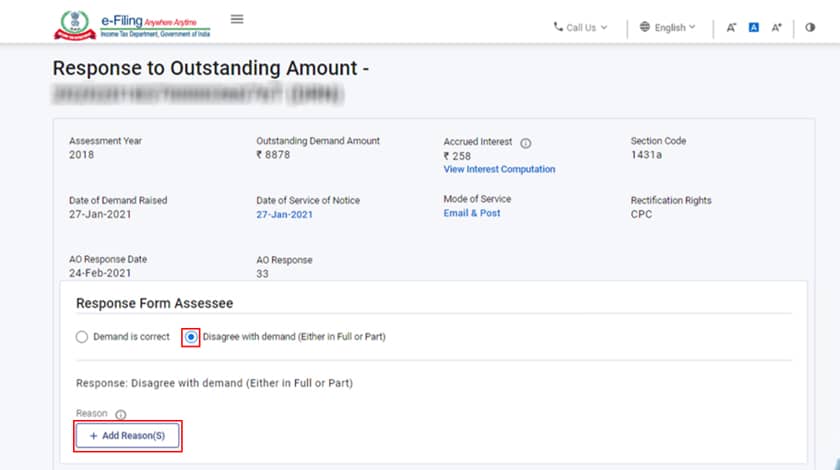

Option 2: Disagreeing with the Demand

Choose the option to disagree with the demand (either in full or in part) on the Response to Outstanding Amount page. Then click Add Reasons.

Choose from the available options, then click Apply to indicate the reason(s) you disagree. (You may choose a single choice or more.)

Reasons for Disagreement -

- Demand has already been satisfied - In this case, there are three sorts of alternatives available based on their relevance. Choose the appropriate option, and then enter the required information, including the amount, BSR code, date of payment, serial number of the challan, and, if available and applicable, the challan's CIN.

- Demand has already been decreased by correction or revision - Provide the order date, demand amount following correction, and other information about the AO, etc.

- By appellate order, the demand has already been decreased. The department must nonetheless provide the appeal impact; do this by providing the date of the order as well as the appellate order's passing authority (as well as the order's reference number).

- By appellate order, the demand has already been decreased. The department must nonetheless provide the appeal impact; do this by providing the date of the order as well as the appellate order's passing authority (as well as the order's reference number).

- A corrected return has been submitted to CPC. If you choose this justification, do include more details about the filed updated return.

- Rectification has been sent to the assessing officer. Mention the application date and any observations the taxpayer may have.

- Others - If there is another reason other those already stated, choose it and add a remark.

Select each of the objections you specified in Step 2 and fill out the relevant fields on the Response to Outstanding Amount page after choosing the proper grounds for your disagreement.

Note: Against the reason you provided the details, the completed status will be shown.

After providing information for each of the specified reasons, click Pay Now to make the final payment due (if you just partially disagree).

.jpg)

You can pay your taxes by going to the e-Pay Tax page after you click this. You will be directed to the Response to Outstanding Amount page after making your payment; click Submit to send your response.

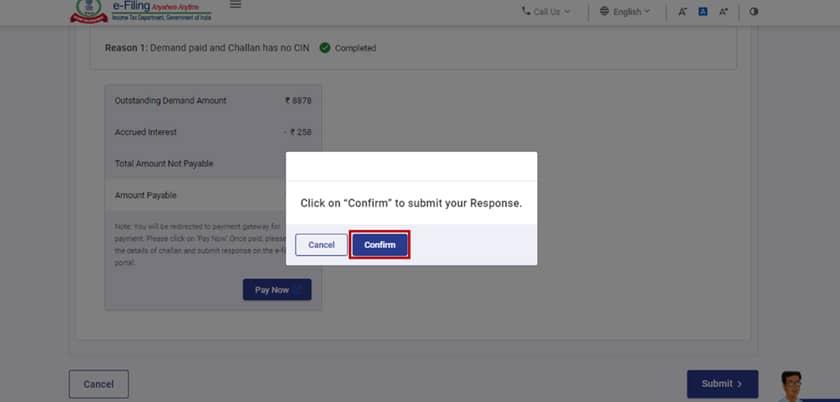

Click Confirm to confirm your submission.

On successful submission, a success message and a Transaction ID are shown. Please remember the Transaction ID for reference in the future.

You will receive the following information following submission in response to outstanding demand:-

.jpg)

Time Limit to Respond to the Demand

As per the Income Tax Act, the taxpayer is required to pay the amount mentioned in the demand notice within 30 days from the date of its service. However, in exceptional cases, the Assessing Officer may reduce this period with prior approval from the Joint Commissioner of Income Tax (JCIT).

If you need more time to make the payment or wish to pay the demand in installments, you can apply to the Assessing Officer before the expiry of the 30-day period. The Assessing Officer may consider such requests based on their merits and make a decision accordingly.

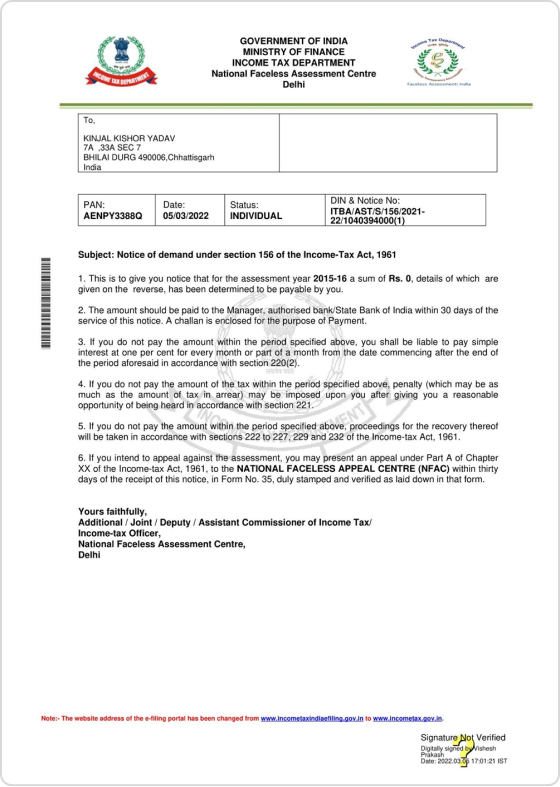

Sample Notice under Section 156

A sample notice under Section 156 of the Income Tax Act may include the following information:

The notice would typically contain details such as the taxpayer's name, Permanent Account Number (PAN), assessment year, amount payable, due date, and instructions on how to respond.

Consequences of Delay and Penalty for Delay

Failure to pay the amount mentioned in the income tax demand notice within the specified time can lead to certain consequences and penalties. Here are the key implications:

Interest u/s 220(2)

If the payment is not made within 30 days of receiving the notice, interest under Section 220(2) becomes applicable. The interest rate is one percent per month or part thereof. This interest is applicable even if the Assessing Officer has approved an extension of the payment period or allowed payment in installments.

Penalty u/s 221

The Assessing Officer has the authority to levy a penalty under Section 221, which can be up to the amount demanded in the income tax notice. However, the penalty can be avoided if the taxpayer can provide valid reasons for the default. It is important to note that the taxpayer must be given a reasonable opportunity to be heard before imposing the penalty.

Read More:- Income Tax Challan - How to Pay Your Income Tax Online?