The Tax Credit Statement, also known as Form 26AS, is crucial documentation for file taxes. The requirement to manually file IT returns required the download of Form 26AS. The statement's scope has now been increased to include information on international transfers, mutual fund purchases, dividends, refund specifics, etc.

Each tax-related piece of information pertaining to you is listed in one place on Form 26AS. PAN (Permanent Account Number). The TRACES website makes it simple to view and download. To make sure that the TDS withheld from your income is actually deposited with the income tax department, it is helpful to check the information on the TDS certificate.

Information on Form 26AS is readily available.

The following details are shown on Form 26AS:.

- Taxes deducted from your income by all tax payers.

- Information about the sources of taxes that each tax collector has collected.

- the taxpayer's advance payment of tax.

- Taxes paid via self-assessment.

- The taxpayers (PAN holders) have paid the regular assessment tax.

- Information about any income tax refund you received during the fiscal year.

- Information on high-value stock, mutual fund, and other transactions.

- .

- information about taxes that were refunded on the sale of real estate.

- Details of TDS defaults that occurred during the year (after processing TDS returns).

- Information about transactions is reported in GSTR-3B.

The brand-new. AIS, Effective 1 June 2020, will also include details on specific financial transactions, ongoing and concluded assessment proceedings, tax demands, refund requests, and the current data displayed in the form.

What are the format and components of Form 26AS?

- Part A:. Information on Source Tax Deducted.

- Part A1: Details of Source Tax Withheld for Forms 15G and 15H.

- Part A2: Details of Tax Deducted at Source on the Sale of Real Estate Under Section 194(IA)/TDS on Real Estate Rent Under Section 194(IB)/TDS on Payment to Residents Contractors and Professionals Under Section 194M. . (For the seller/landlord of the property/payee of resident professionals and contractors).

- Part B:. Information on Tax Paid at Source.

- Part C:. Details of Tax Paid (not including TDS or TCS).

- Part D:. Refund details that have been paid.

- Part E:. Details of the SFT Transaction.

- Part F:. Details of Tax Deducted at Source on the Sale of Immovable Property Under Section 194(IA)/TDS on Property Rent Under Section 194IB/TDS on Payment to Resident Contractors and Professionals Under Section 194M. . (For Property Purchasers, Tenants, and Payers of Local Contractors and Professionals).

- Part G:. TDS Defaults (Statement processing).

- Part H:. Specifications of Turnover as Per GSTR-3B.

Read Also:- Form 15G and Form 15H: How to Save TDS on Interest Income

Part A:

Information about Tax Deducted at Source.

Details about the TDS deducted from your salary, interest income, pension income, prize money, etc. are included in Part A of Form 26AS. The amount of TDS deducted and deposited to the government, as well as the deductor's TAN, are also included. Each quarter, this information is made available.

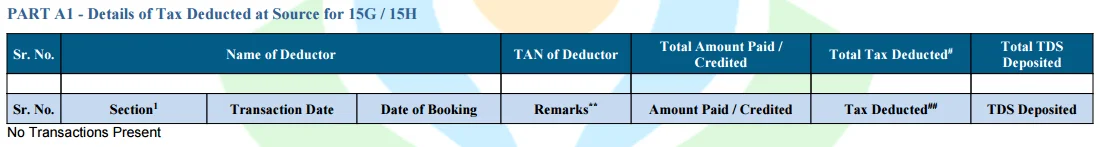

Part A1: .

Details of Tax Deducted at Source for Forms 15G and 15H.

Since the taxpayer has submitted Form 15G or Form 15H, details of income for which no TDS has been deducted are provided here. If you've turned in Form 15G or Form 15H, you can check the status of the TDS deduction. This section will say "No transactions present" if you haven't turned in Form 15G or Form 15H.

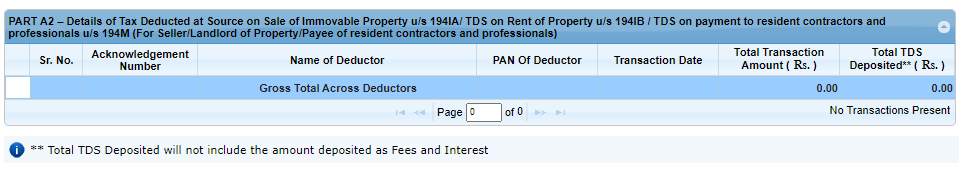

Part A2:

Here are the details for the following entries:.

- TDS on the sale of real estate that is movable under Section 194(IA) (for the property seller).

- TDS on property rent in accordance with Section 194IB (for the property landlord).

- TDS on payments to local contractors and professionals under Section 194M. . (for a payee of local contractors and experts).

In other words, it will display entries if you sold or rented a property, received payment for a contract or professional service during the year, and TDS was deducted on those payments.

.

.

Part B:

Information about Source Tax Collection.

The Tax Collected at Source (TCS) by the Seller of Goods is shown in Part B. Details of the seller who collected tax from you are shown in entries in Form 26AS.

.

.

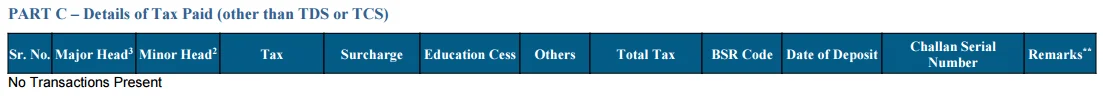

Part C:

Tax Payment Information (other than TDS or TCS).

This page will show any tax-related information that you have personally deposited. specifics of the advance tax. We have self-assessment tax as well. It also includes information about the challan (BSR code, deposit date, CIN) that was used to deposit the tax.

.

.

Part D: .

Specifics of the paid refund.

If there is a refund, information about it will be presented in this section. The assessment year to which the refund relates, the method of payment, the sum paid, the interest paid, and the date of payment are all mentioned.

Part E: .

Specifics of an SFT transaction.

Banks and other financial institutions are required to notify the tax authorities of high-value transactions. Here, high-value purchases of mutual funds, real estate, and corporate bonds are all detailed.

Part F: .

Details of Tax Deducted at Source on the Sale of Real Estate Under Section 194(IA)/TDS on Real Estate Rent Under Section 194(IB)/TDS on Payment to Resident Contractors and Professionals Under Section 194M.

This section will display specifics regarding the TDS that you withheld and deposited when you purchased a property, paid rent to the tenant, paid for contractual work, or paid professional fees.

Part G: .

TDS Defaults (Processing of Statements).

This section displays TDS defaults (following the processing of TDS returns). Demands put forth by the assessing officer are not included, though.

Part H:

Information on Turnover as reported on GSTR-3B. .

The taxpayer's turnover as reported in the GSTR-3B return is displayed in this section.

How should I view Form 26AS?

The two modes listed below are available for viewing Form 26AS.

- the TRACES website.

- Your bank's online banking service.

Where Can I Download Form 26AS From TRACES?

Downloadable versions of Form 26AS are available at. the TRACES website. How to view and download Form 26AS from the TRACES website is detailed below.

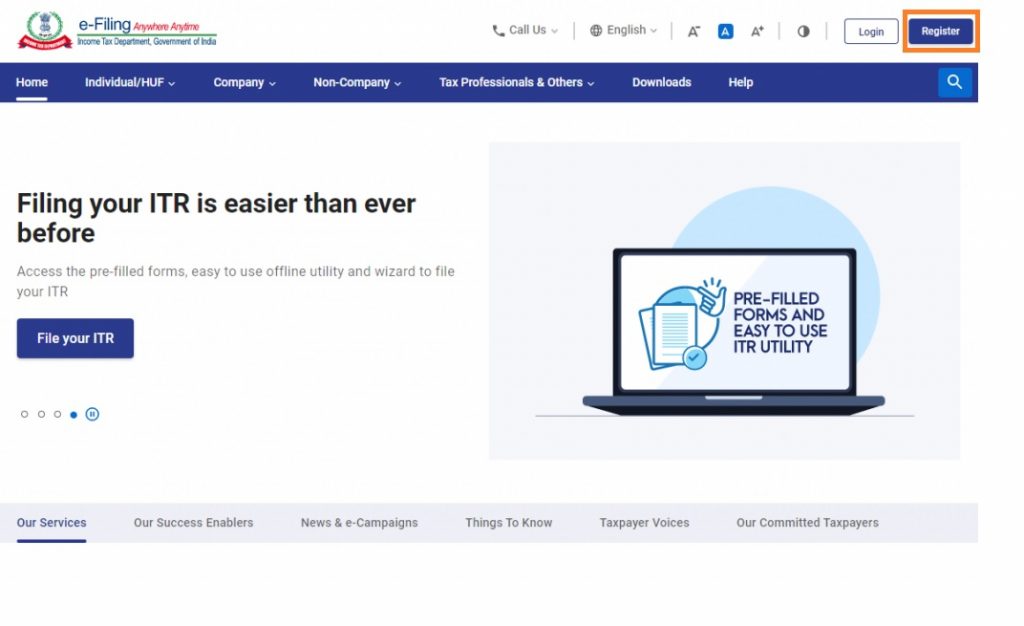

Step 1: The e-filing website can be accessed.

Step 2: Your user ID can either be your PAN or your Aadhaar number. An error message will appear if the user ID is incorrect. Provide a valid user ID and continue.

Step 3:.

- Enter the password to proceed.

Step 4:

- The screen that follows will appear. Access the "e-file" page. In the drop-down menu that appears after clicking on "Income Tax Returns," choose "View Form 26AS.".

- Look at Form 26AS.

Step 5:

- The TRACES website will be displayed after you click "Confirm" on the disclaimer. Don't worry, this step is required and completely secure because it is a government website.

- Website for TRACES.

Step 6: TRACES (TDS-CPC) is a website that you are currently on. Click "Proceed" after choosing the box on the screen.

Step 7: To view your Form 26AS, click the link at the bottom of the page and then select "View Tax Credit (Form 26AS)".

Step 8:

Select the Assessment Year and the desired Form 26AS format. . Leave the format set to HTML if you want to view it online. The option to download it as a PDF is also available. After making your selection, enter the "Verification Code" and press the "View/Download" button.

Step 9: Form 26AS can be opened once it has been downloaded and viewed.

How do I view Form 26AS using the net banking feature?

PAN holders with net banking accounts at any authorized bank have the option to view Form 26AS. . Your PAN number must be connected to that specific account in order for you to view your Form 26AS. This service is offered without charge. . The list of banks listed with NSDL through which you can access your Tax Credit Statement (Form 26AS) is as follows:.

- the Axis Bank Limited.

- India's central bank.

- The Maharashtra bank.

- The Baroda Bank.

- Citizens Bank N. A.

- Business Bank.

- City Union Bank, Limited.

- The ICICI Bank Limited.

- Identity Bank Limited.

- Bank of India.

- The Kotak Mahindra Bank Limited.

- Asian Bank.

- Bengal Bank.

- Chinese Commercial Bank.

- Bank of India, State.

- National Bank of Mysore.

- Treasury State Bank.

- Patiala's State Bank.

- Limited by The Federal Bank.

- Its name is The Saraswat Co-operative Bank Limited.

- The UCO Bank.

- India's Union Bank.

How do I use the e-filing website for the income tax department?

Registering or logging in on the website is the first step. an electronic filing website. The website will let you know if you're already registered after you enter your PAN number under the "Taxpayer" tab. .

It's likely that you are already registered if you've ever filed electronically. Please look for any potentially helpful information by searching your email for "incometax . gov . in.".

You can access the portal to complete income tax compliances by entering your user ID and password.

Note: . Your PAN number is your user ID. In the event that you can't recall your password, you must. change your password.

Gains from Form 26AS.

- When tax is deducted/collected and deposited with the government tax authorities by authorized deductors/collectors, Form 26AS contains vital information.

- In Form 26AS, a taxpayer may view a complete list of all TDS/TCS-related financial transactions for the applicable fiscal year.

- When filing an Income Tax Return (ITR) on income, Form 26AS is helpful in calculating income and claiming tax credits. .

- When filing an Income Tax Return (ITR) on income, Form 26AS is helpful in calculating income and claiming tax credits. .

- With the aid of Form 26AS, a taxpayer can verify that refunds were received during the relevant financial or assessment year.

New Form 26AS is available as of June 1, 2020.

From 1 June 2020, the taxpayers' information will be accessible in a new Form 26AS, which looks like this:.

- source-based tax collection and source-based tax deduction.

- specific financial transactions' specifics.

- Advance taxes and self-assessment taxes are examples of income-tax payments made by the taxpayer.

- Tax demands and refunds.

- both ongoing and finished income-tax cases.

The government has not yet informed or clarified the specific financial transactions that need to be reported on the new Form 26AS. The new form is in line with the Budget 2020 announcement to simplify compliance and accurate tax payment.

Introduction of Annual Information Statement (AIS)

The tax division has once more unveiled an. AIS, or annual information statement. To include new information such as foreign remittances, off-market transactions, interest on income tax refunds, mutual fund purchases and dividend details, as well as the breakdown of another person's salary and ITR data. .

Previously, the authorized entities had provided these records to the income tax department. For instance, a licensed dealer (e. g. Every payment made to non-residents (by banks) must be reported on Form 15CC, and transfer agents and depositories must report off-market transactions (such as transfers between Demat accounts, transfers as gifts, and so on). ). The information that employers have uploaded on the TRACES portal is also available in Form 16 as salary breakdown details. .

Additionally, the ITRs filed by others provide the tax department with information about specific transactions made by the taxpayers. Property sellers, for instance, include information about buyers in their ITR.

The advantages of an annual information statement (AIS).

- The new AIS will extract taxpayer data and give them pre-filled returns. The income tax department has planned the pre-filling of data in stages.

- The department is also attempting to eliminate any duplicate or incorrect information from the new report. If you think the information in the AIS statement is incorrect, you can provide feedback online. The taxpayer may submit feedback asking for a modification in the event of inaccuracy or errors. Additionally, the taxpayer may provide feedback regarding bulk data. Additionally, a tool for uploading feedback offline through AIS is also available. The AIS is available for download by taxpayers in the PDF, CSV, and JSON formats.

- Taxpayers Information Summary (TIS) and Annual Information Statement (AIS) are both included in the AIS report. TIS is a condensed statement that shows total value, whereas AIS is a full statement. The processed value, as shown by TIS (i. e. the amount determined by income tax records) and derived value (i. e. the value revised after taking into account comments from the taxpayer). The derived data in TIS will automatically update in real-time after feedback submission.

- The will be made simpler by the new AIS statement. File an ITR for taxpayers since more information is available in a single statement. Taxpayers have the ability to spot inaccurate data reported in AIS and offer feedback for remedial action.

- Furthermore, tax authorities could quickly spot any discrepancies between the information provided by the taxpayer and the source by comparing the two. By doing this, the problem of notices from the income tax division and tax leakages will be diminished.

Forms 16/16A and 26AS, the TDS Certificate.

Even though they might appear to contain the same information, a TDS certificate, Form 16/16A, and Form 26AS serve different purposes. Form 26AS, which is required to file ITR, can be used to collect all pertinent data pertaining to TDS. To get a TDS Certificate, though, is necessary. The introduction of Form 26AS was justified by the need to maintain information transparency and give taxpayers the ability to cross-check and verify the accuracy of the information they provided on their TDS certificates with the information entered on Form 26AS.

You are unable to check your information and identify any potential inconsistencies without a TDS certificate or Form 26AS. With both, you can cross-check, compare the specifics, and identify any discrepancies. If there are errors, you can have them fixed.

Additionally, Form 26AS does not show the breakdown of the income and deductions claimed under Sections 80C to 80U, which is available in the TDS certificate, making it insufficient for filing an ITR in the case of salaried individuals. So, in addition to Form 26AS, you also need a TDS certificate.

Verify the following in the TDS certificate using Form 26AS.

The information on the TDS certificate, i.e. Form 26AS, must be cross-referenced. e. To ensure that the TDS deducted from the payee's income was deposited with the income tax department, fill out Form 16 (for salaried individuals) and Form 16A (for non-salaried individuals).

The following are additional items that taxpayers should confirm on Form 26AS and the TDS certificate:.

- Verify the deductor's TAN, name, PAN number, refund amount, and TDS amount to make sure they are all correctly reflected. A discrepancy in the details could cause issues when submitting an ITR.

- Check to see if the government has actually received the Tax Deducted at Source (TDS) amount listed on the TDS certificate. Taxpayers can confirm this by comparing the Form 26AS data and the TDS information on paystubs. Contact the deductor and request that they file the TDS return and submit the tax amount as soon as possible if they have not already done so on your behalf.

- Examine Form 26AS to see if the TDS mentioned in Forms 16 and 16A is correctly reflected. The deductor has withheld the tax on your behalf but has not deposited it with the income tax department if the TDS shown in the TDS certificate is not reflected in Form 26AS. In such a situation, you must act and get in touch with the deductor to rectify it.

Inform your deductor and have any discrepancies between the TDS certificate and Form 26AS corrected right away. Verify that your PAN number and other information were used by the deductor to file TDS. The deductor and you may experience issues if the TDS is filed under the wrong PAN in many instances.

Question and Answer sections.

How do I get Form 26AS or the Tax Credit Statement?

Log in with your account information to view or download Form 26AS. password for the income tax portal.

- View Form 26AS by going to the "e-File" tab on the homepage, selecting "Income Tax Returns," from the drop-down menu, and then clicking. .

- You will be taken to the TRACES portal once you have read the disclaimer and clicked the "Confirm" button.

- Click the "Proceed" button once you have accepted and agreed to use the Form 16/16A created by TRACES. .

- Now view Form 26ASA by clicking "view tax credit (Form 26AS)". .

- Determine the "Assessment Year" and the "View type" (HTML, Text, or PDF). .

- The "View/Download" button should be clicked. .

- A screen displaying Form 26AS will appear. Click the "Export PDF" button to download it as a PDF. It will download the Form 26AS as a PDF file.

How do I view Form 26AS using online banking?

Through net banking at any of the accredited banks, taxpayers may view or download Form 26AS. Only if the PAN is mapped to that specific account can Form 26AS be viewed. Click here to determine if your bank is permitted to offer the option of downloading Form 26AS.

The best way to check Form 26AS online without logging in?

to look at or download Form 26AS from the. e-filing portal for income taxes. you have to sign up for yourself. However, you can do the same through the net banking service of the authorized bank where your account is maintained if you want to download without logging in.

Use your internet banking login information to access your net banking account, then click the "Tax Credit Statement" to view more information.

Click here to determine whether your bank has the proper authorization to deliver Form 26AS.

When is Form 26AS updated?

When the income tax division processes the TDS returns submitted by the TDS deductors, Form 26AS is updated accordingly. Therefore, the 31st of May is the deadline for submitting TDS returns for the fourth quarter. Additionally, it takes seven days to process the submitted TDS return. The most recent TDS reported against your PAN is updated on Form 26AS once processing is complete.

What is the pdf version of the password for Form 26AS?

The taxpayer's date of birth or incorporation, in the format DDMMYYYY, serves as the password to open the Form 26AS in pdf format.

What does Form 26AS mean when it says the transaction date and the date of booking?

The term "transaction date" refers to the earlier of the date of credit or the date of income payment. .

Date of booking refers to both the amount booked in Form 26AS and the date on which the TDS return is processed. This day will come after the TDS return has been submitted.

What purpose does Form 26AS serve?

You can find all the information about the tax credit for taxes paid during the financial year on Form 26AS. A taxpayer's various income sources are listed on Form 26AS, which gives information about any money taken out as TDS or TCS. Additionally, it reflects the taxpayer's high-value transactions and advance tax/self-assessment tax information. Details of specific financial transactions, ongoing and finished assessment proceedings, tax demands, and refunds are now included in Form 26AS.

How come Form 26AS is necessary?

Because it shows that tax was deducted and collected at source on our behalf, Form 26AS is necessary. Furthermore, it affirms that the organizations (banks, employers, etc. ) have accurately withheld taxes on our behalf and deposited them into the government's account so that credit for the same may be claimed.

How to make corrections to Form 26AS? How to correct errors in Form 26AS?

The deductor must be notified and asked to submit a corrected TDS return in order to fix the error in Form 26AS. No changes to the Form 26AS may be made by the deductee themselves.

What does the date of booking in Form 26AS mean?

The date of booking refers to the day the TDS return is processed and the amount is entered into Form 26AS. The day after the TDS return has been filed will be this day.

How soon will TDS appear in Form 26AS?

After the deductee files a TDS return and the CPC processes it, tax deducted at sources is reflected in Form 26AS. The processing of the submitted TDS return by CPC typically takes seven days.

How can I download Form 26AS in Excel format?

To download Form 26AS in excel format, simply follow the steps listed below:.

- Log in to your income tax e-filing account > Select "View Form 26AS" from the drop-down menu under "e-File," then click "Income Tax Returns" from the menu.

- After reading the disclaimer, press "Confirm.".

- After clicking the "Proceed" button, the user will be taken to the TDS portal where they can accept and use the Form 16/16A generated by the TRACES portal.

- View tax credit (Form 26AS) can be accessed by clicking. .

- Choose "Assessment Year" and "Excel" as your "View type" options. "View/Download" is selected by clicking.

.